The thing about crafting a useful Recap at each quarter’s end? Rare times do exist when nearly every style tilt deployed by a manager contributes positively to superior investment performance and the following quarterly review practically writes itself. This quarter-end Recap is such a time for Lake Jericho. But before diving into the Q3 Recap, for context let us first revisit a few points made in the closing of the Q2 Recap.

Closing the Q2 Recap I highlighted what we believed to be the most significant near-term challenge facing us as your investment manager; global political instability and the impact upon economic growth forecasts. I lamented our diminished ability to confidently estimate global growth expectations with the challenge of evaluating potential outcomes of uncharacteristically significant qualitative factors, such as political uncertainty, that fundamentally influence those expectations. While we had before us the data supporting a forecast for broad economic expansion in the U.S. and international markets, we also had before us a great deal of political and social uncertainty. We still do. Our projection at that time was that despite statistical evidence supporting a positive growth bias for both domestic and international markets, the political and social uncertainty would leave us flat for a period of time. Were you to read a sampling of other firm’s already published Q3 investment reviews what would you find? You would observe a pattern in those reviews along the line of “solid but uneventful quarter”. If only looking at the “headline” indices (those you hear about on the evening news), words like “solid”, “uneventful”, and “flat” are generally on point. But the headline indices do not tell the total story.

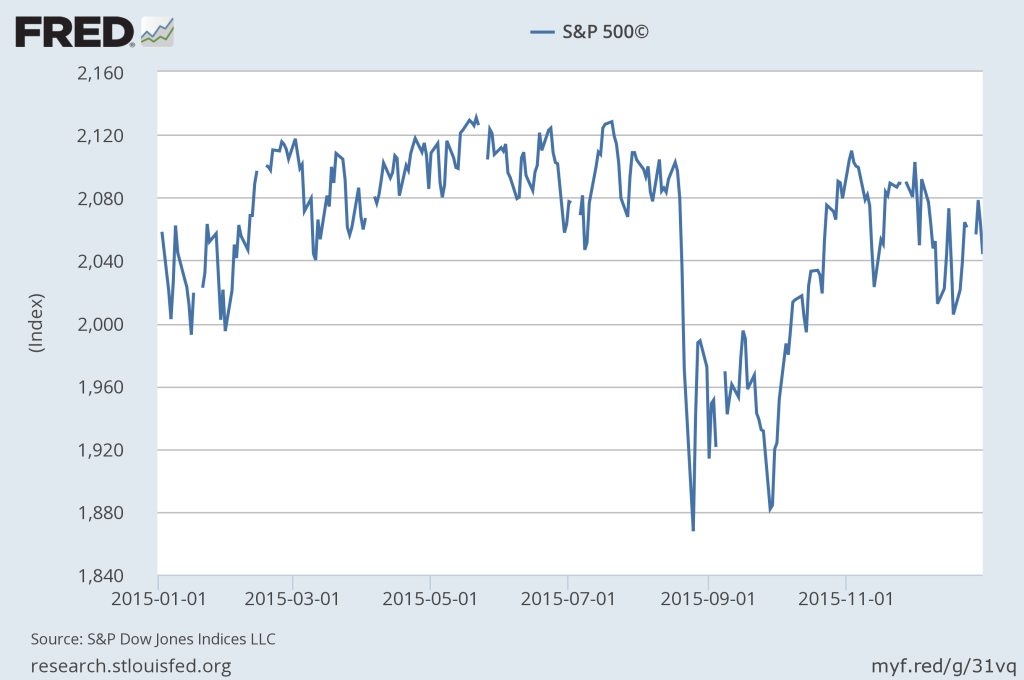

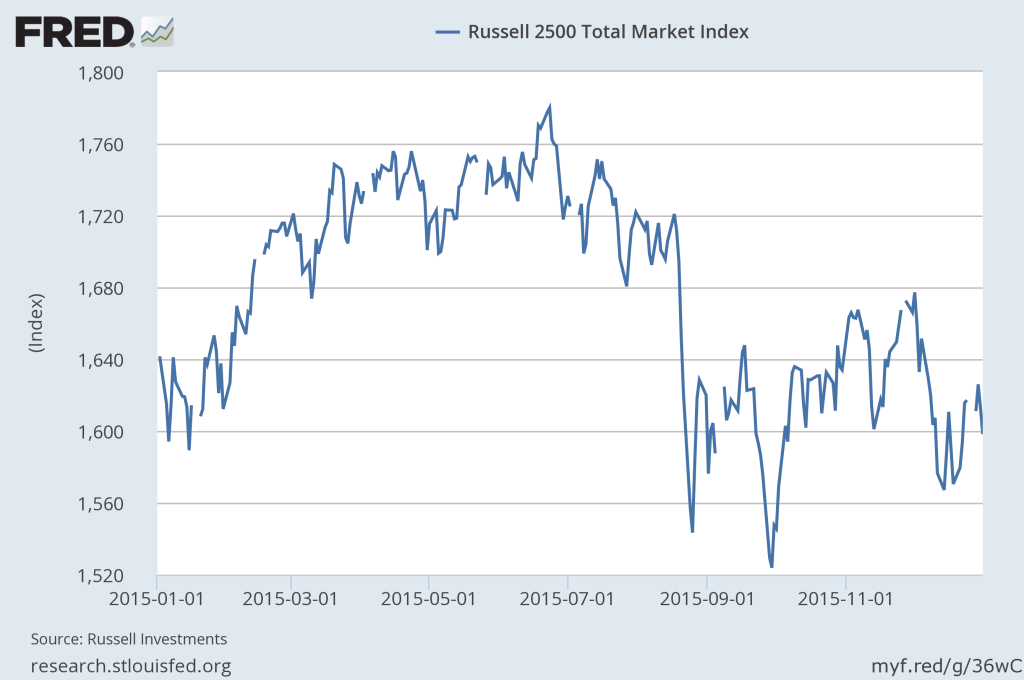

Most of those other investment reviews minimize the volatility that surrounded the end of Q2 and the early days of Q3. You might recall the surprising June 23rd “Brexit” vote in which the U.K. elected to leave the European Union. Markets reacted wildly, resulting in a significant downturn in global equity markets the following two trading days. U.S. stock markets recovered strongly the next two trading days after those. Shortly into Q3 the major U.S. equity indices had sufficiently rallied to sit comfortably at new all-time highs. Foreign developed markets, and particularly the E.U. markets, were much slower to recover but did so over the course of Q3. Mostly. So sure, it was a “solid but uneventful quarter” once we got past the first few weeks of Q3. If marking the post-Brexit recovery as beginning on June 28th, U.S. large-company stocks were up 8.9% through September 30th, with most of that recovery happening by July 8th. Measured from the open of Q3 to close of Q3, U.S. large-company stocks were up 3.8% for the quarter. So after that quick rebound within the first two weeks of Q3, U.S. equity markets as measured by large-company stocks moved within a narrow trading range for the remainder of the Q3. The CBOE’s S&P 500 Volatility Index (the VIX), a broad measure of market instability, reached lows in Q3 seen only a handful of times in the past 25 years. But large-company stocks do not tell the total story.

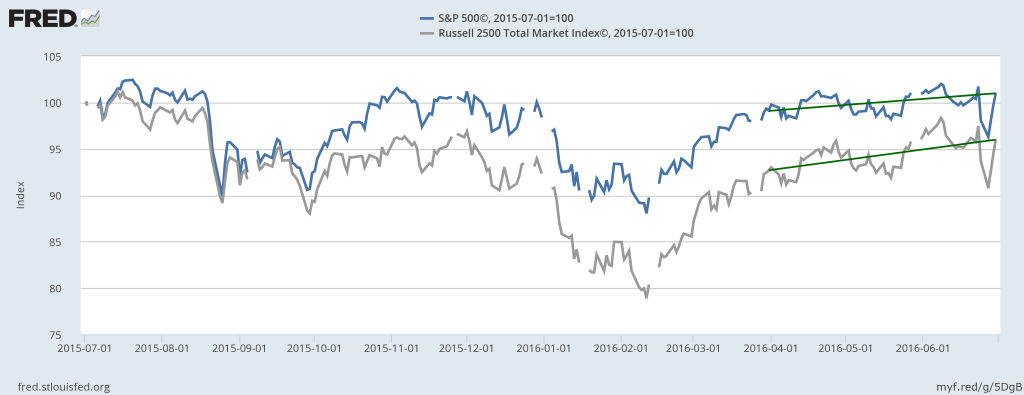

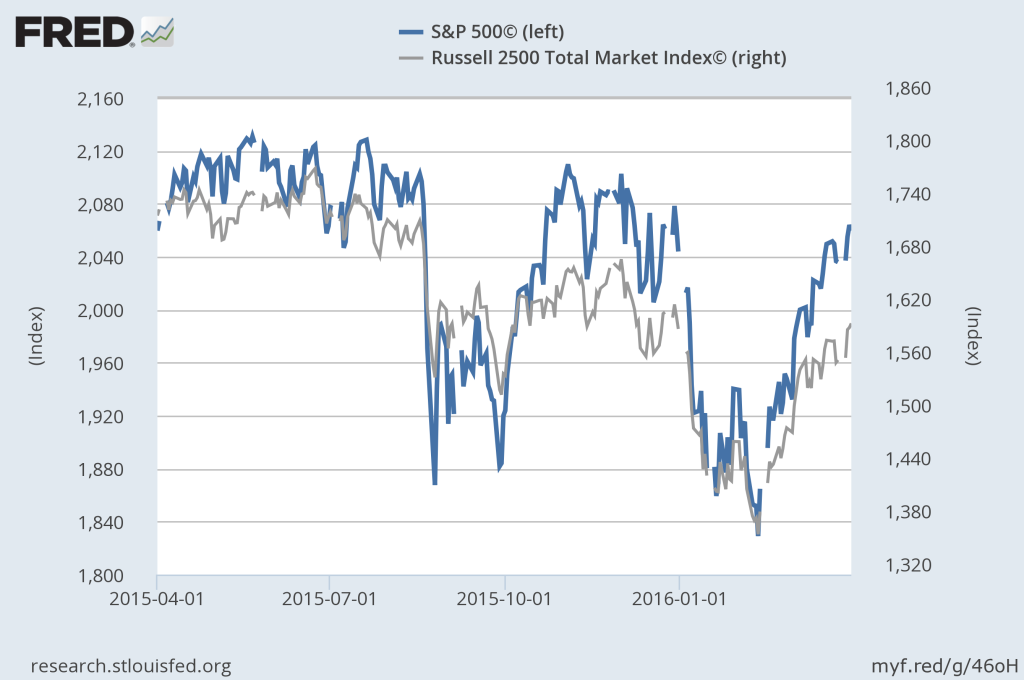

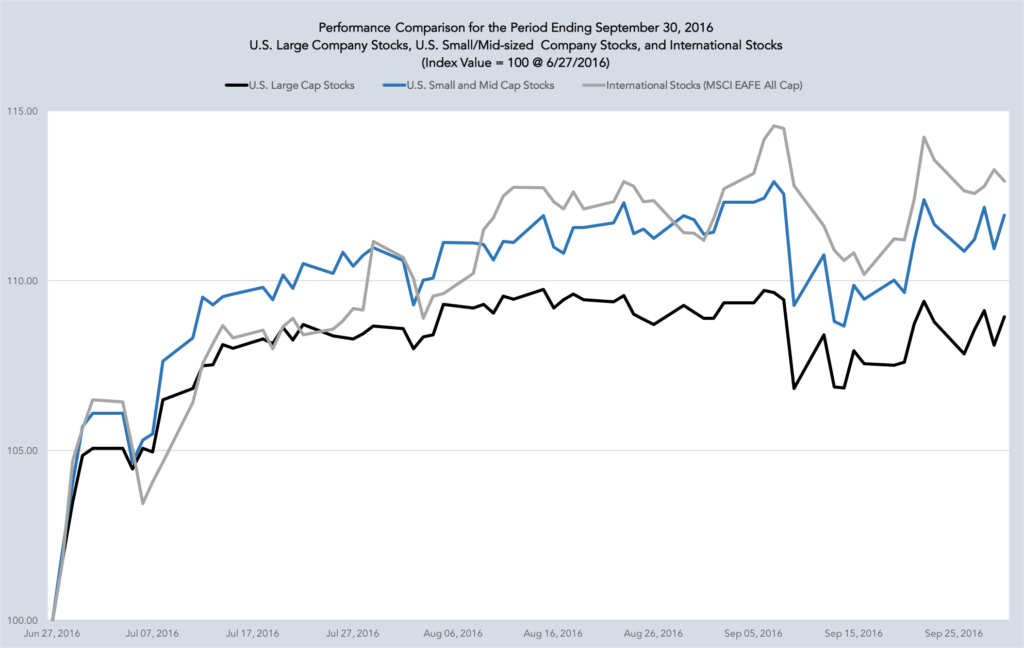

Chart 1 illustrates the difference between large-company U.S. stocks (the MSCI USA Large-Cap Index represented by the black line), small- and mid-sized company U.S. stocks (the MSCI USA SMID Index represented by the blue line), and international stocks (the MSCI EAFE Index represented by the gray line) for the post-Brexit recovery period. When you chart the recovery of large-company stocks in the U.S. compared to small-, mid-, and international company stocks you see that valuable opportunity existed over the course of Q3 to achieve superior relative performance versus the performance of the headline/large-company indices.

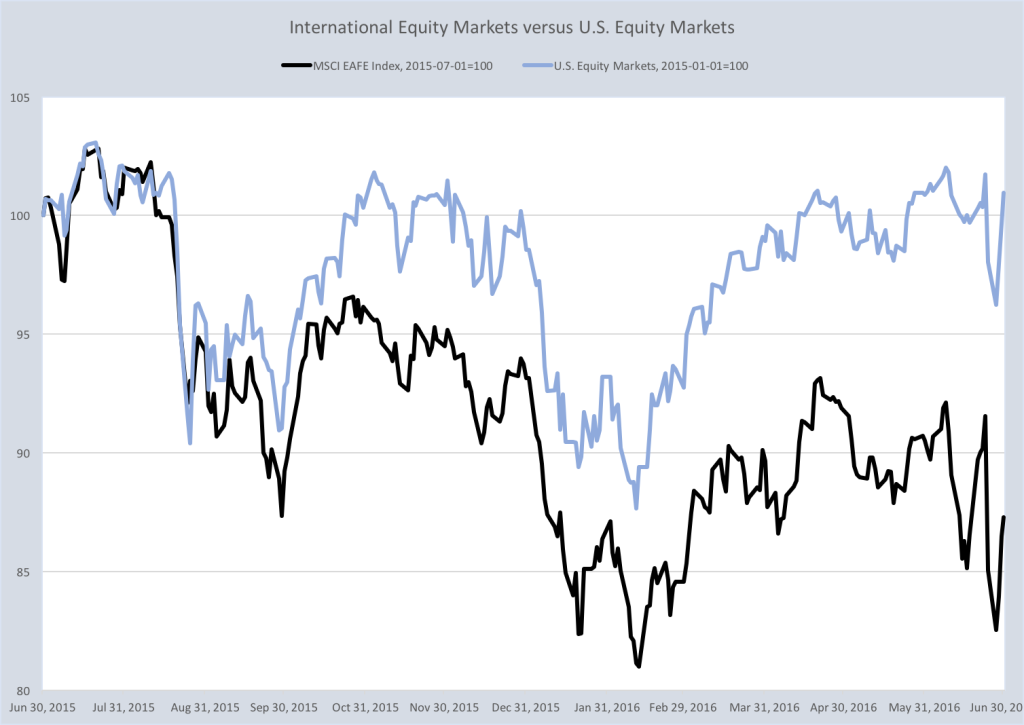

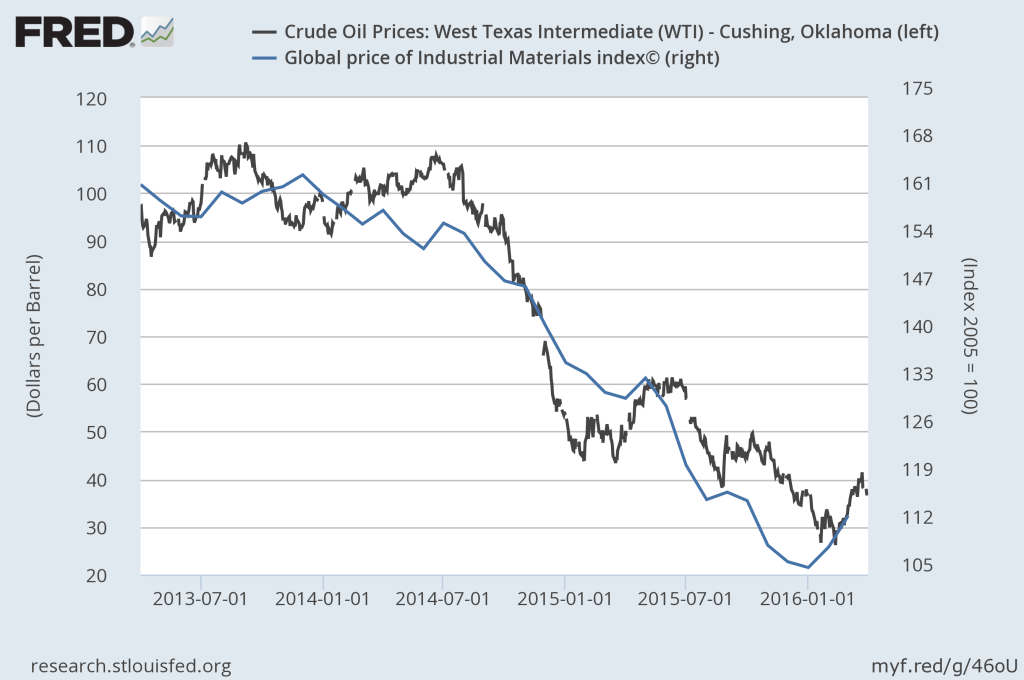

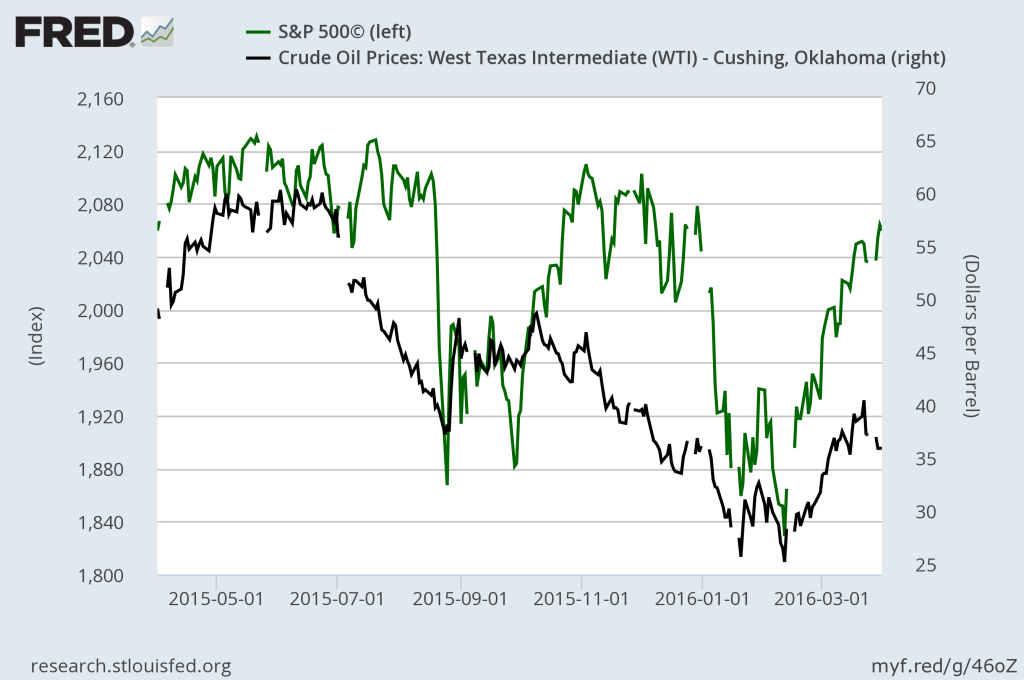

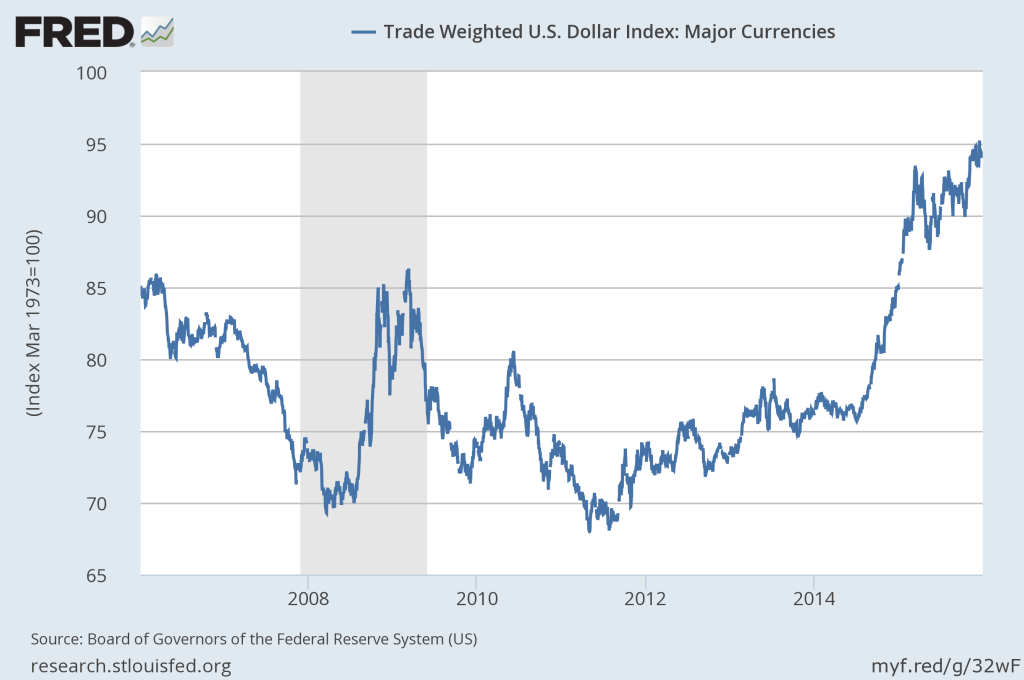

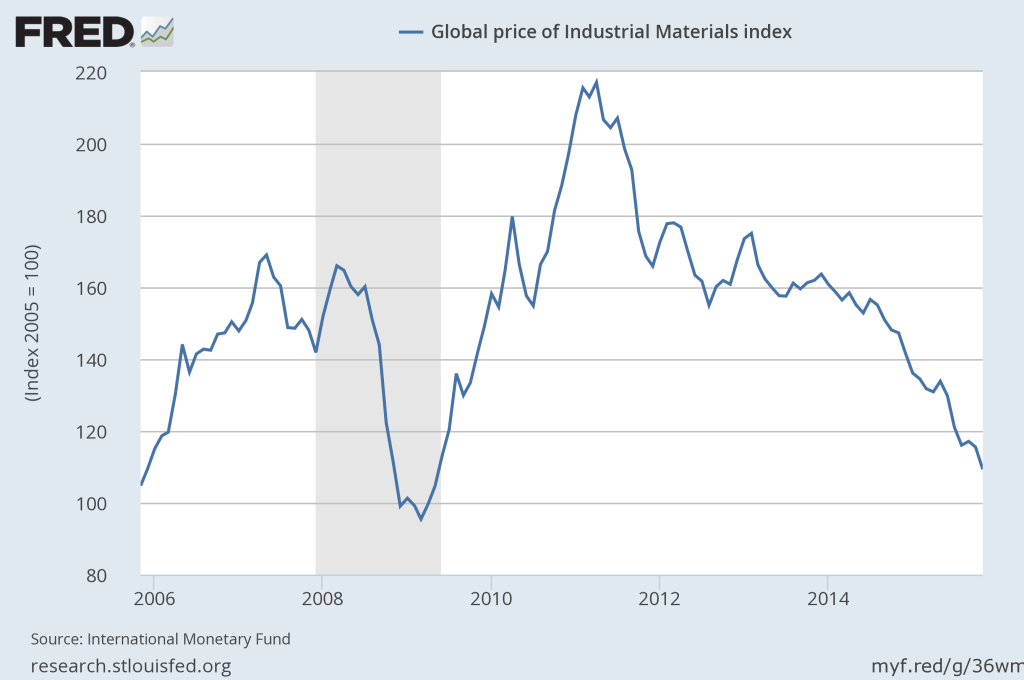

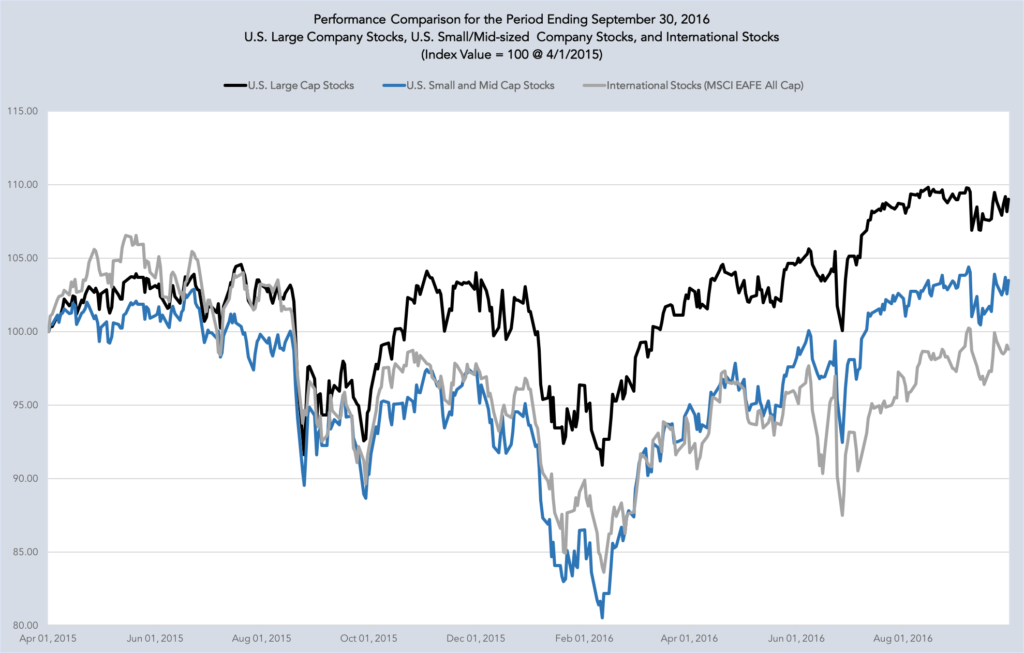

In fairness and full disclosure, let’s examine the same index data in Chart 1 but move the start date back 18 months to April 1, 2015, prior to the past year’s major economic events. Chart 2 shows market impacts of Grexit to Brexit, the continued trudge out of the depths of the U.S financial crises, heightened concerns regarding global growth rates, commodity and energy price collapse, dollar strengthening, fears of rising domestic interest rates to actual real negative interest rates abroad, and the most bizarre election cycle in memory. Chart 2 highlights two market tendencies that influence Lake Jericho’s equity management results over time. The first tendency is that during periods of heightened market volatility (the more palatable industry term for market declines) there exists a thing called “volatility clustering”. Volatility clustering, again a palatable industry term, means that when things go south, most everything (all types of stocks, bonds, alternative investments, everything) go south together. It’s a particularly vexing challenge to portfolio diversification as a means for risk reduction as the hoped-for risk reduction benefits of diversification tend to disappear just when you need them most. This tendency greatly influences how Lake Jericho views and manages volatility in client portfolios. The second tendency is that during periods of heightened market volatility investors flock to the “save haven” of U.S. securities, particularly U.S. government securities and large-company U.S. stocks. This “flight to safety” compounds and extends the downward pressure on other sectors of the investment universe. These tendencies are all on display in Chart 2. First, during sharp downturns all parts of the market tend to move down together. Second, during periods of heightened uncertainty few, if any, sectors will outperform large-company U.S. stocks. Third, when markets recover it is possible, through Lake Jericho’s strategic and tactical sector diversification methods, to meaningfully recover lost ground.

While Lake Jericho fully expects to capture a great percentage of upside in rising markets, and is adept at limiting downside risk during volatile markets, our strategic and tactical sector allocation methodology is most successful at capturing excess return when markets are less directionally clear and advantageous trading opportunities are more abundant. Our forecast for a flat market, combined with our sector allocation decisions, and opportunistic trade execution provided for a solid, if not superior, investment performance during Q3. I will now walk through that decision making process with you and detail how each decision impacted overall investment performance during the quarter.

Lake Jericho’s long-term portfolio construction process involves five distinct levels of strategic decision making. The first level in our process is the global allocation decision; how much of a portfolio should be invested in international markets versus invested in the U.S. market. Our long-term outlook for growth rates in international markets continues to exceed that of our long-term outlook for U.S. growth. The higher growth expectation is why we invest significant assets in international markets. Our allocations are less than a global market-neutral allocation, of course, as all Lake Jericho clients are U.S. based. However, our allocations are higher than the typical U.S. based investment advisor. These global investment decisions then inform asset allocation decisions amongst stocks, bonds, and alternative asset classes within U.S. or international markets (the second level of the strategic decision making process).

As demonstrated in Chart 2 above, the past 18 months have been a challenge as a result of this higher international equity allocation. But just as we said in our Q2 Recap, mean-reversion is real and is part of the reason we remain true to our discipline and committed to our total international allocation level within portfolios. This commitment was rewarded during Q3 as international equity investments as measured by the MSCI EAFE Index returned 6.9% while large-company U.S. stocks returned 3.8%. Even our somewhat beleaguered overweight to E.U. equities returned 5.0% during Q3, besting large-company U.S. stocks by 1.2%. Believing that the U.K. would soon signal the formal process for leaving the E.U., and that the post-Brexit recovery for non-currency hedged U.K. stocks would slow, we did reallocate most E.U. portfolio overweights to existing, and less concentrated, Developed Markets positions prior to quarter-end. As we anticipated, on October 2nd British Prime Minister Teresa May did report that the U.K. would invoke Article 50 by the end of Q1 2017, triggering the formal process of exiting the E.U. and a pull-back in U.K. and E.U securities.

Turning to domestic market decisions and more widely recognized indices, the S&P 500 Index also returned 3.8% for Q3, for a YTD return through September 30th of 7.8%. Small- and mid-sized company stocks as measured by the Russell 2500 Index fared far better with a quarterly gain of 6.6%, for a YTD return through September 30 of 10.8%. Chart 2, again, highlights the outperformance of large companies versus small- and mid-sized companies from April, 2015 through the early days of 2016, then the reversal of that performance pattern since mid-February. Chart 1 makes more clear this continued divergence during Q3 during which small- and mid-sized companies narrowed 2015’s performance gap significantly. These “size” decisions are another among the five levels of our portfolio construction process. Investment performance during Q3 was helped by our continued overweighting of small- and mid-sized companies versus a U.S. equity market-neutral portfolio.

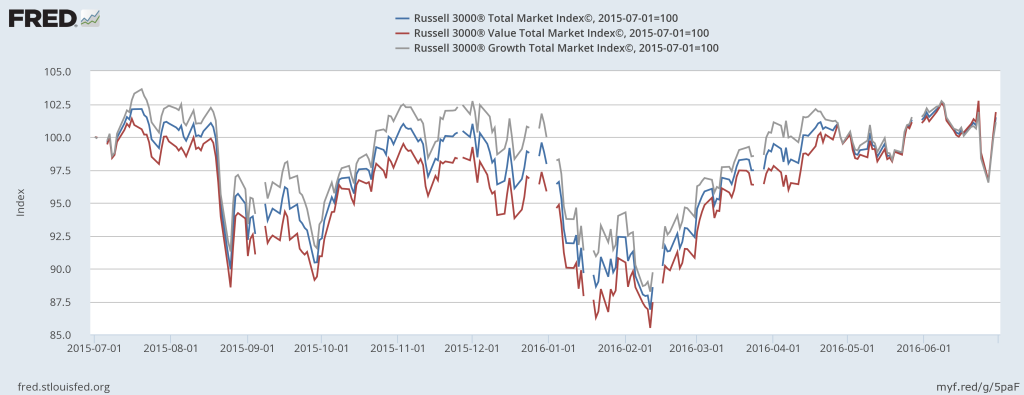

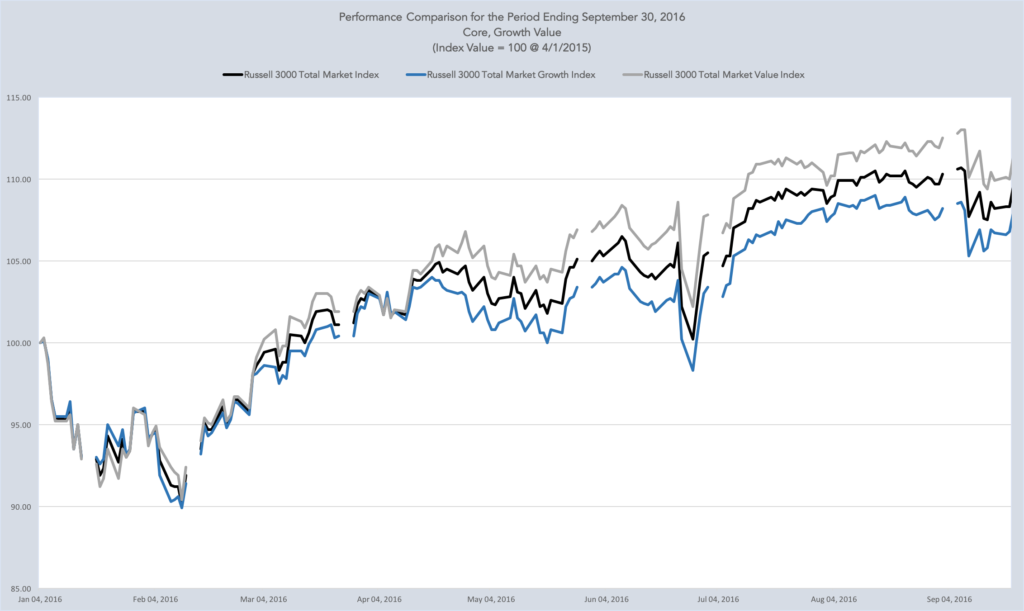

Company valuation metrics are yet another distinct level of our long-term decision making process. Company valuation categorization is a combination of quantitative measurements and qualitative art, referring to companies as value-oriented, growth-oriented, or core. In layperson’s terms, it boils down to “how expensive is the stock versus its earnings expectations”. Although Lake Jericho managed portfolios most often represent elements of each category, our long-term bias tilts toward value-oriented investments. Some refer to our style as “growth at a reasonable price”, a fair label as far as labels go. When examining Chart 3 below, you will see that value-oriented investment strategies (the gray line) continue to outperform both growth-oriented strategies (the blue line) and core strategies (the black line) during 2016. After underperforming both growth and core strategies for all of 2015, the trend reversed during Q1 and value strategies have outperformed since. Value strategies have now outperformed both growth and core strategies for the trailing 18-month period. Value-oriented strategies, which we do significantly overweight versus a market-neutral portfolio, have contributed positively to portfolio performance by besting core strategies by 2.0% and growth strategies by nearly 8.5% thus far during 2016.

As for bond markets, they were surprisingly calm in Q3, particularly when compared to the tumultuous final week of Q2. As with the equity markets, initially negative reaction to the surprise Brexit vote quickly faded and bond markets returned to the typical task of assessing economic data and policy moves from the world’s major central banks. In the US, economic momentum continued to track broadly in a positive direction and by September the U.S. Federal Reserve’s Open Market Committee was split on whether to increase interest rates. The extension of accommodative policy by the Bank of England in August pressed gilt yields lower, while the European Central Bank’s decision to leave its current range of support measures unaltered left Bund yields unchanged. And then there is Japan. The Bank of Japan already owns about 40% of Japanese government bonds (JGBs). At its current pace of buying, the BOJ would hold about $2 out of every $3 of existing JGBs by 2020. Most doubt that any additional efforts by the BOJ to jump-start economic growth would have an impact, and would most likely have unforeseen and unintended consequences. Japan, along with China, are big question marks in Asian markets and the reason we underweight both equity and bond exposure to the region.

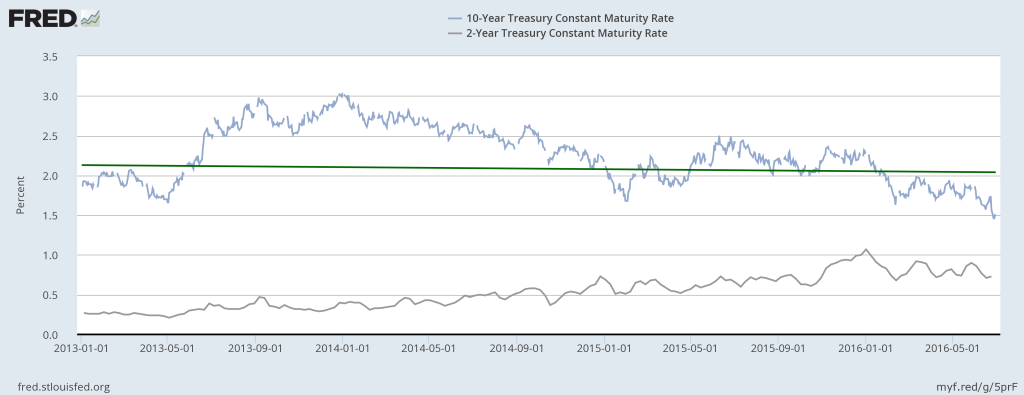

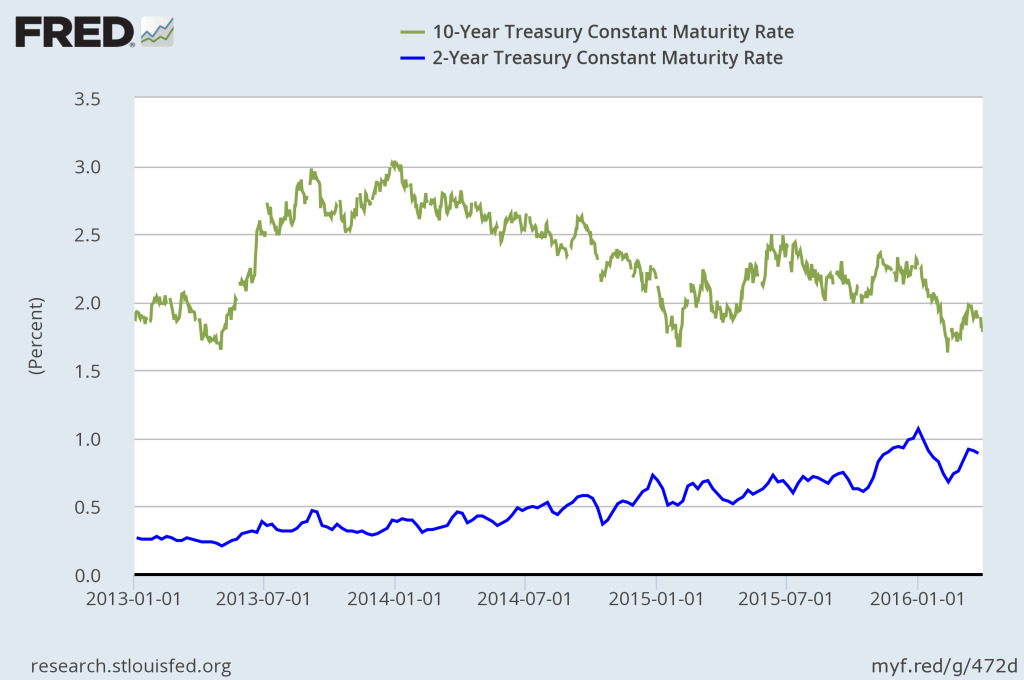

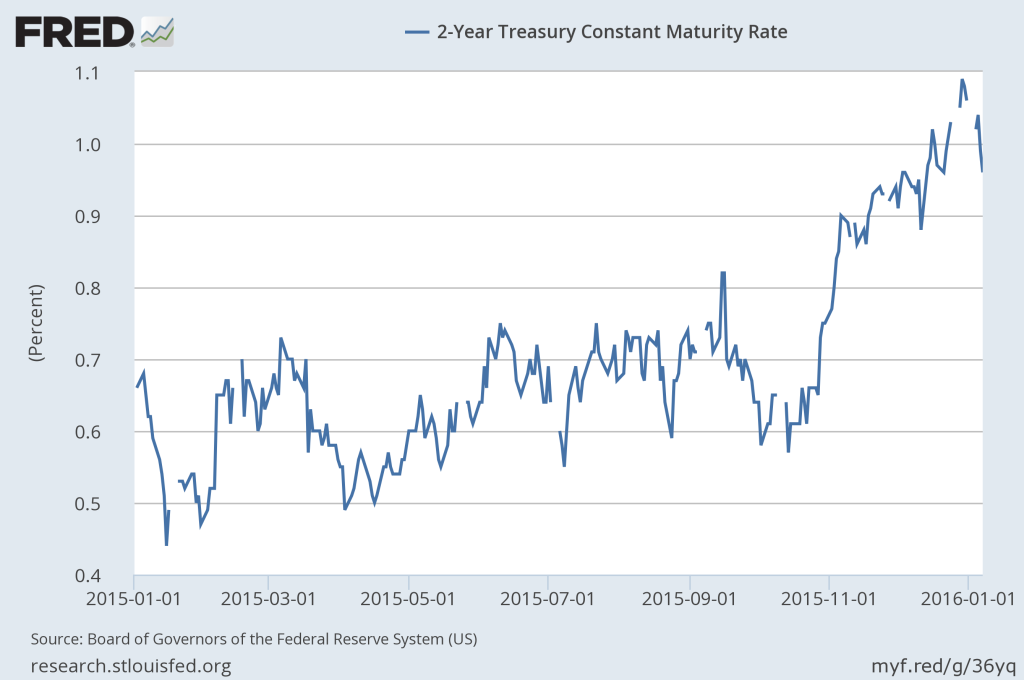

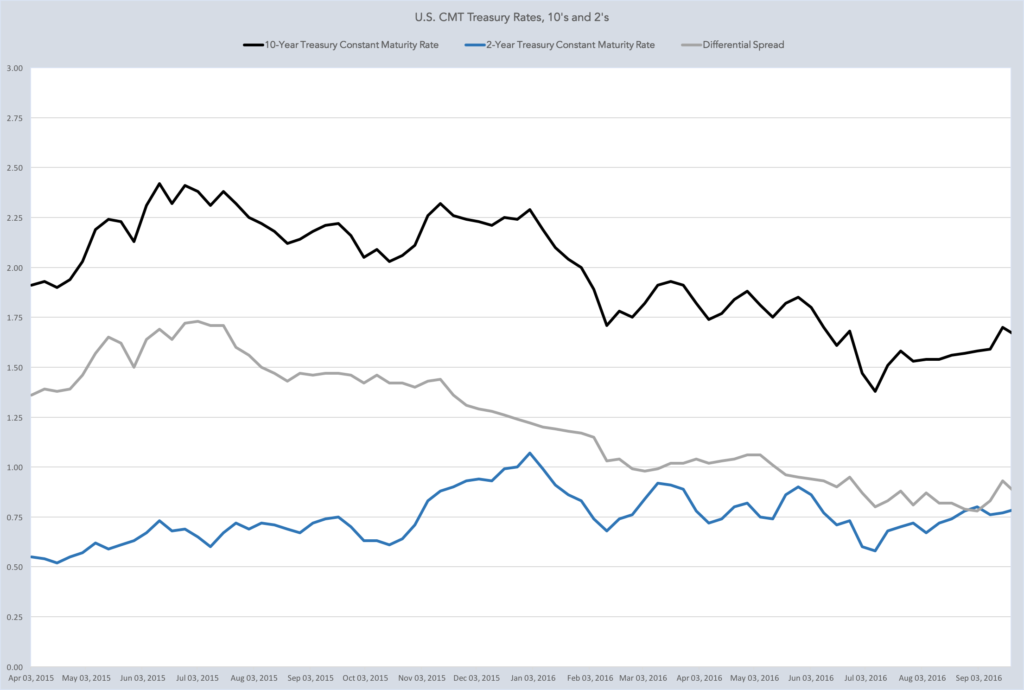

At home, the 10-year U.S. Treasury yield climbed from 1.47% to 1.59% in Q3. The 2-year U.S. Treasury yield climbed from 0.55% to 0.75% in Q3. Spreads between 10’s and 2’s have been steadily decreasing meaning the incentive to invest longer term is increasingly less compelling. Increased yields were enough to slightly suppress bond market total returns during Q3, but certainly not enough to push returns into negative territory. The Barclays U.S. Aggregate Bond Index, a broad measure of bond market total return positioned somewhere in between 2-year and 10-year bonds (a gross over-simplification but an acceptable way to frame the idea) was up 0.8% is Q3, up 5.8% year-to-date, and up 5.2% for the last year through September 30th. Our U.S. bond holdings returned about 0.5% for the Q3, 3.6% year-to-date, and about 3.2% for the year ending September 30th.

We have maintained, and continue to maintain, a less yield-sensitive position for clients than that represented by the Aggregate Index. With interest rates at historical lows, we feel that there is much more risk of interest rates rising in the U.S. than of rates continuing to fall. This low-yield reality is a significant element in why traditional methods of portfolio diversification are less effective today, and part of the reason why volatility clustering is on the rise. Our U.S. bond positions remain invested at a 2.8 year duration, versus the Aggregate Index duration of about 5.5 years duration. Lower duration bond investments will not fall in price as dramatically as a longer duration investment when interest rates increase. The best way to think about duration and how it represents risk to bond investment performance is that should interest rates increase equally across the maturity spectrum, a 2.8 year duration investment will be negatively affected by about half of what the 5.5-year duration investment would be. However, if interest rates remain the same, or fall, the shorter duration investment not only has a lower yield, but also will not increase in value as dramatically as the longer duration investment. Our global bond holdings currently have a negative effective duration, meaning that this portion of client portfolios performs positively in periods of rising interest rates. That is the trade off we make to mitigate price risk in the bond allocations of our client portfolios, and one of the few portfolio decisions that detracted from relative performance during Q3. We are sticking with that decision.

Finally, strategic and tactical sector weighting is the fifth level of our portfolio construction process and an important part of how we add value over time. Few portfolios will match all sector allocations, or sector allocation percentages exactly, or the timing of investments perfectly, and these factors certainly impact exact contribution to performance of our sector decisions. However, our process of underweighting U.S. equity market-neutral benchmark allocations in favor of overweighting higher expected growth sectors (currently materials, medical devices and instruments, and biotech/genomics) added about 0.50% in excess return to client portfolio during Q3. Our pharmaceutical sector overweight has not performed as expected, and remains hamstrung by negative headlines about poor leadership, moral hazard related to aggressive pricing strategies, and the resulting political rhetoric in the election cycle. Pharma sector overweighting, where present, reduced portfolio performance by about 0.18% during Q3. Finally, while the consumer space has remained consistent during this year’s volatility, that strength has not translated well into an our forecasted increase in broad discretionary spending. Evidence that it might turn before year-end was fading, and trading opportunities afforded us to exit our consumer discretionary positions at slight gains during Q3. The gains did not move the needle, so to speak, on overall performance so we reallocated the proceeds to other existing sector positions. The net effect to client portfolios during Q3 was about 0.32% of additional return due to our combined sector decisions.

So what does all of this mean for us going into the final lap of 2016? We continue to see upside in our long-term global economic growth estimates, with higher expectations for both foreign developed markets and emerging markets than for domestic markets. For the near term we are projecting greater market volatility. Markets seemingly got accustomed to the recent summer lull, but we fully expect the reprieve to be short-lived. As we trudge towards U.S. election day we expect more of the same range-bound activity, but expect it to be…well…more active. Post-election, should Secretary Clinton take the White House and the GOP retain the House, we expect another round of record highs for U.S. equities, a continued rebound in developed and emerging market assets, and continued strength in global bonds. Should Trump take the White House? Or should Clinton prove successful and the Democrats take both houses of Congress (a long-shot to be sure)? I am not alone in projecting that all bets are off under either scenario. I feel no need to venture into the politics of either scenario, only to repeat one of our most often stated market realities; uncertainty is worse for stock markets than certain, but bad news. A Democrat in the White House, GOP-controlled houses of Congress, and total gridlock in Washington might be bad news, but it is a certainty that Wall Street knows and perversely finds comfort.

Any other leadership combination creates uncertainty and could be bad news for the markets. Bad for how long depends on the nature of the combination. As we have marched towards election day, we have been building larger-than-typical cash positions in all of our portfolios to provide additional measures of down-side protection. As well, in certain portfolios we are tactically deploying small allocations to investment vehicles that are, negatively correlated with the S&P 500 Index, or to other specific at-risk sector exposures. These “inverse” tools are inexpensive and effective methods of securing portfolio insurance that directly benefits from down-side movements.

Post-election, we expect the U.S. Federal Reserve to press forward at their December meeting with increasing interest rates at home. We expect other major central banks will recognize the limits on their own easing policies. Again, we suspect that there will be downward pressure on markets after that December meeting through the end of the year and perhaps into the new year’s earnings reporting season. We plan to remain a bit cash-heavy and relatively more defensive compared to our normal positions through the early days of 2017. How the Q3 earnings reporting season unfolds might further inform how we position portfolios through year-end. If significant events unfold that dramatically alter our views or strategies I will be in quick contact as usual.

We are available at any time, any day of the week, to discuss specific portfolio and performance questions. I will also be in touch with each of you prior to year-end to conduct a thorough review of goals and objectives, make any needed changes as a result, and to walk through a few administrative tasks that we need to tackle going into 2017. Until then, be well, enjoy the rest of your weekend, and thank you!

A.J. Walker, CFA CFP® CIMA®

Founder and Senior Consultant

Lake Jericho, LLC