Jockeying for Position Before the Final Turn.

Less than two weeks until the call to post for the 144th running of the Kentucky Derby! If ever a time existed to use thoroughbred racing analogies for investment markets, that time is now. If you are betting with the financial media pundits, then your money is on the race having made the final turn, that this market is thundering down the final stretch. But are we really down to the wire? I do not believe we are. The measures by which Lake Jericho evaluates long-term strategic decisions indicate that while the track is currently muddied, the fundamentals have not changed in a material way. Markets have merely returned to normal levels of volatility, fundamental factors such as global economic growth remain positive, corporate earnings are strong and rising, and after a 10.0% February correction stock prices became more reasonable than before. Our view is that global economies, markets, and investors still have the wind at their back. The market has not yet made the final turn, so we have more distance yet to run.

Q1 Review

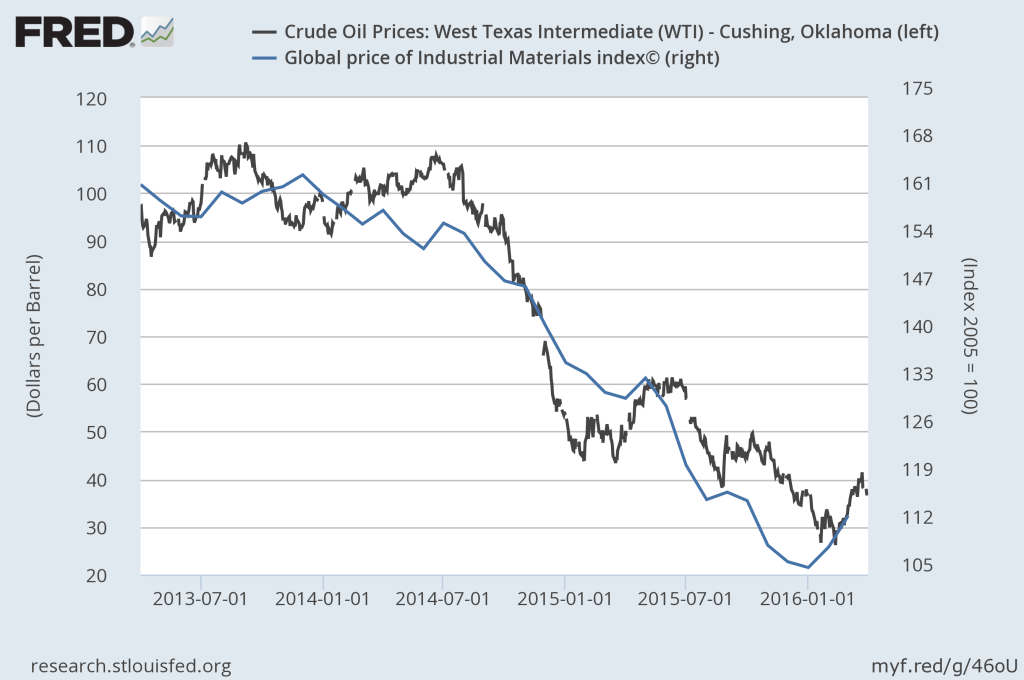

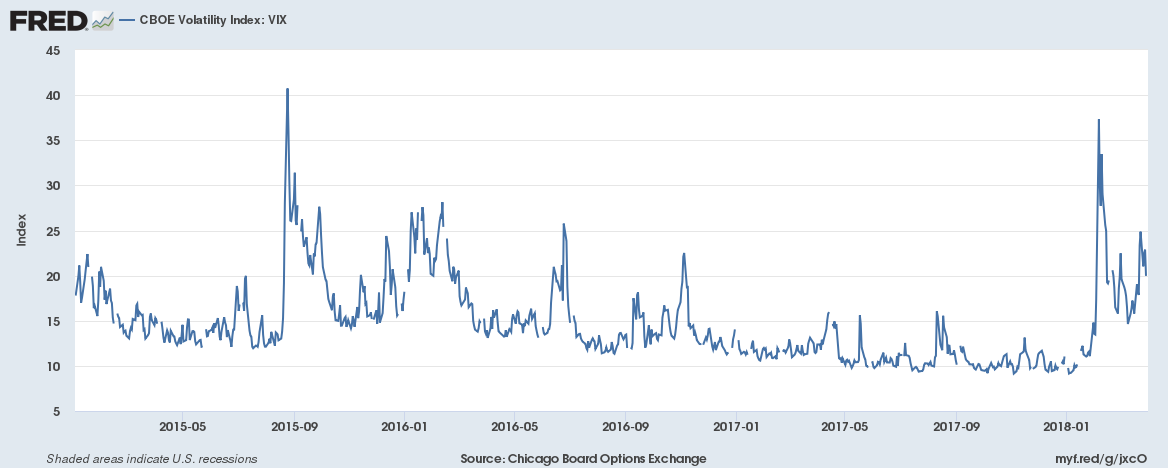

2018 picked up as 2017 left off: low volatility and rising stock prices. During 2017, the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) index, a common measure of stock market volatility, averaged just 11.1%, the lowest annual average on record. For context, the 10-year rolling VIX average is about 18.0% meaning that 2017 demonstrated nearly 40.0% lower volatility than the average post-financial crisis experience. During 2017, the S&P 500® Index (a broad measure of large-sized U.S. companies) posted significant gains every quarter to produce a total annual return of 21.8%. During January, the S&P 500® increased 5.73%, the biggest gain for a January since 1997. January’s close saw markets set another milestone: more than 400 trading days without a drawdown of 5.0% or more.

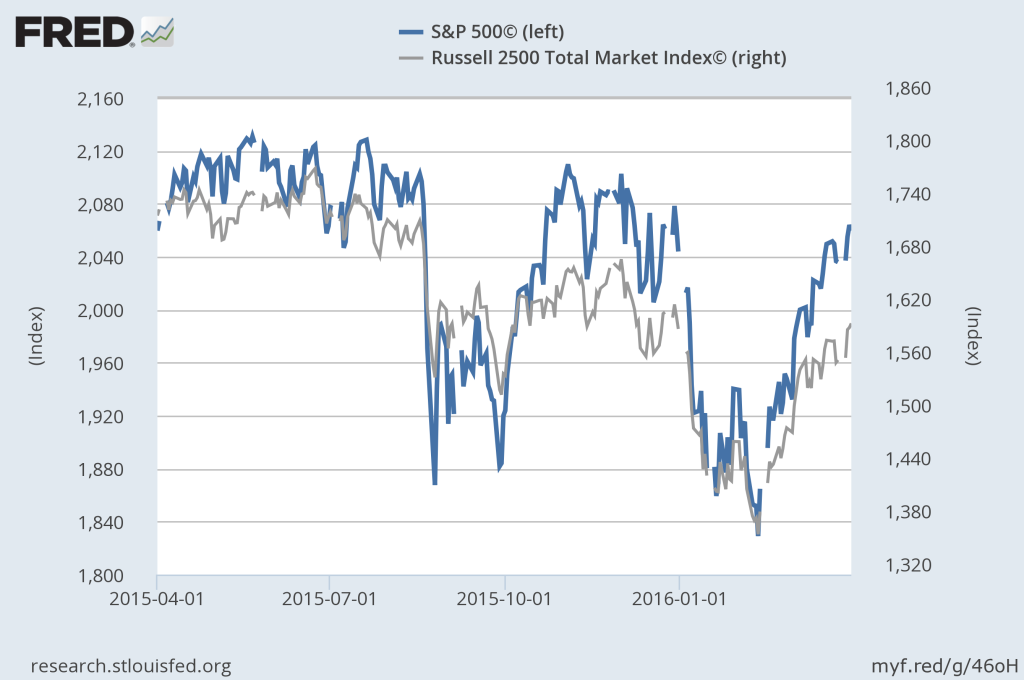

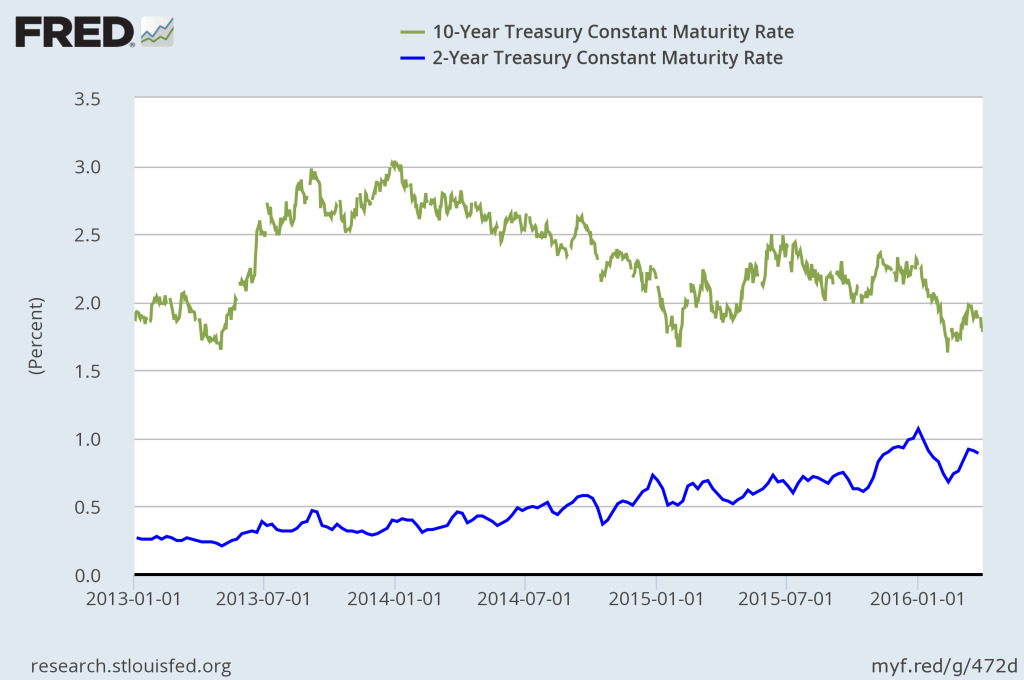

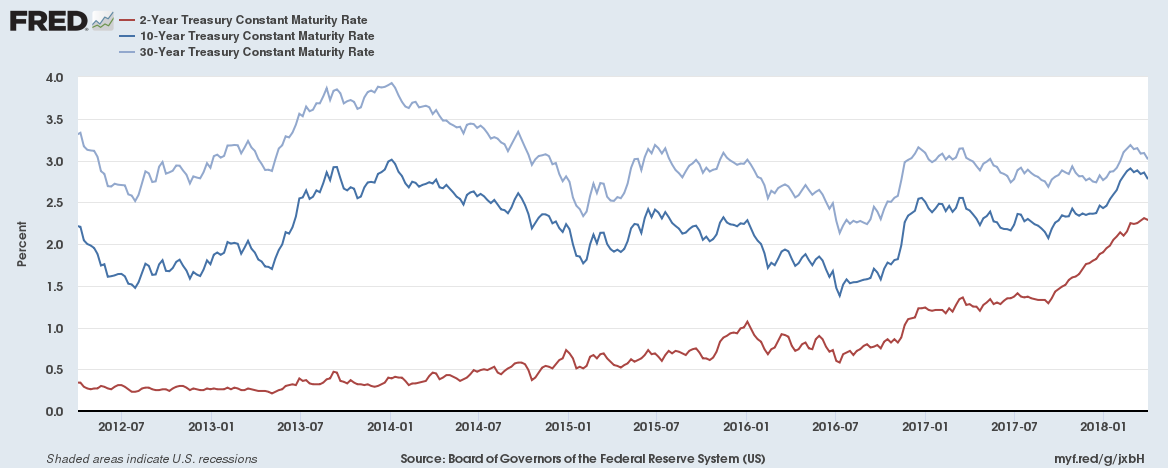

Friday morning, February 2, the U.S. Department of Labor released the Employment Situation Report for January. The report showed solid job growth, a bit larger than expected though not surprising given preliminary data. But the focal point was a 0.3% jump in average hourly earnings. When combined with revisions to previous data the average hourly earnings were up 2.9% year-over-year, the highest wage growth rate since May 2009. There had been a burgeoning assumption that the strengthening economy and a tightening labor market would invite higher wages and wage-based inflation pressures dormant for years. That report gave data-centric life to that assumption, and offered a reasonable basis for the U.S. Federal Reserve to move forward with a more aggressive pace of interest rate increases. Anticipation caused bond prices to fall, pushing U.S. Treasury yields to multi-year highs. The U.S. 10-year Treasury yield, the yield upon which much debt in the U.S. is benchmarked, rose 50 basis points to 2.90%, hitting its highest point since late 2013. Negative headlines warning of rising interest rates that would slow global growth, undermine corporate earnings despite tax reform measures, and insure a ballooning U.S. budget deficit was all that trading algorithms needed to queue up the sell orders. But, the day was still young, and there was more drama to come.

Chart 1: U.S. Treasury Yields

Interest rates are moving steadily higher.

When wrapping up the Q4 2017 Outlook I stated that if we do discover a fly in the ointment with respect to this market, it will come through one of three windows: interest rates, currency values, or commodity prices. Though on-the-money about interest rate risk, I did leave off one important item: domestic political risk. That same Friday was also the day that Trump authorized the release of a GOP House Intelligence Committee memo alleging bias at both the FBI and the Justice Department. The release and the associated headlines accelerated Friday’s sell off given that it compounded political uncertainty in front of the following week’s federal government spending deadline.

Although upon release of that Employment Situation Report markets experienced a 29% spike in the CBOE VIX Index, the most meaningful volatility shock would not come until the following Monday. Having had the opportunity to digest the weekend headlines, programmatic trading drove markets down fast and hard. The VIX experienced a single-day spike of 116%, the largest one-day spike ever recorded. That day also saw the largest single-day point decline ever recorded for the Dow Jones Industrial Average. Over the course of February’s first few trading sessions investors watched the first drawdown of more than 10% since early 2016.

Chart 2: CBOE Volatility Index

A return to historically average volatility following a tranquil 2017.

Although markets quickly rebounded, recovering about 8% of the lost ground, volatility remained elevated. In stark contrast with historically tranquil 2017, markets spent the balance of Q1 alternating between episodes of relief and panic. It was a pattern of strong moves to advance, only to then stumble in field packed with distractions. Those distractions would once again, at the end of Q1, cause markets to weaken and give back much of February’s recovery. In the end, for the first quarter in ten quarters, most market indexes finished in the red.

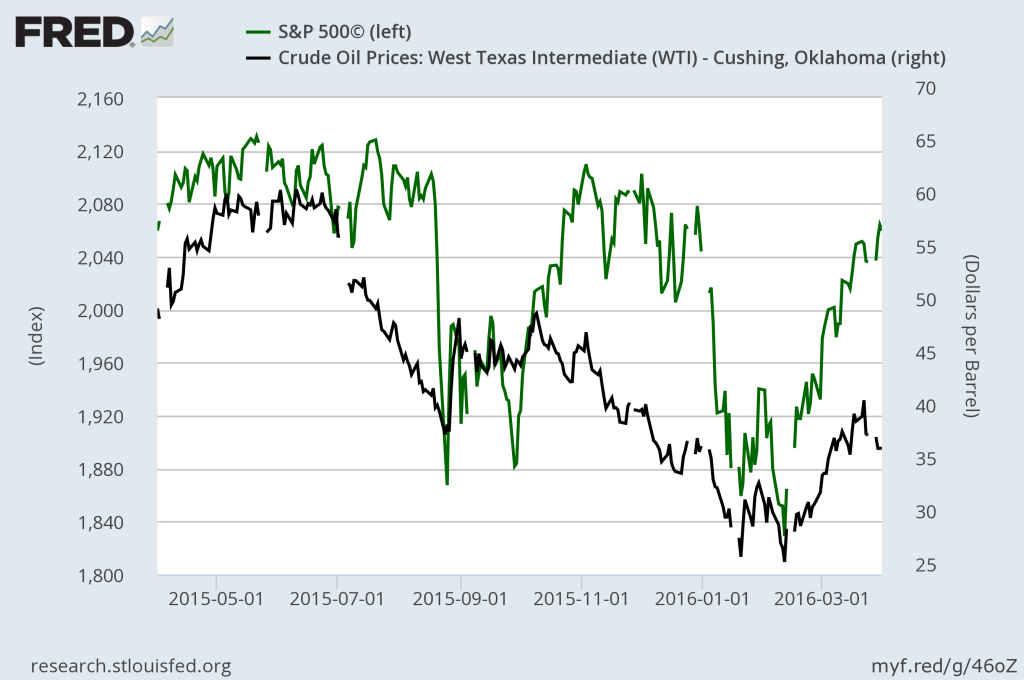

- The S&P 500® Index finished Q1 with a total return of -0.76%.

- The more concentrated, and more interest-rate sensitive, Dow Jones Industrial Average finished Q1 with a total return of -1.96%.

- Small- and mid-sized U.S. companies, as measured by the Russell 2500 Index, outperformed large-company counterparts with a total return of -0.24%. Small- and mid-sized U.S. companies were less affected by the increasing frequency of Trump tweets threatening tariffs and trade-wars as less of their earnings depend upon overseas transactions.

- The bright spot in the U.S. during Q1 was the technology and consumer-cyclical heavy NASDAQ Composite Index with a positive total return of 2.59%. For the NASDAQ, the story was not so much that it was hit less hard by the downturn, rather it had such a large head start during the month of January that when the downturn hit there was more cushion to keep the index from turning negative.

- Foreign market performance during Q1 was comparable to the U.S. market performance. Foreign, large-company portfolios as measured by Morningstar, Inc. finished with a total return of -0.86%. Foreign, small-company portfolios as measured by Morningstar, Inc. finished with a total return of -0.38%. Emerging markets were a bright spot during Q1, finishing with a positive total return of 2.01% as measured by Morningstar, Inc.

- Bond markets, in the face of rising global interest rates, provided little shelter for investors. Interest rates and bond prices are inversely related, so as interest rates increase, bond prices fall. The Bloomberg Barclays U.S. Aggregate Bond Index finished Q1 with a total return of -1.46%. The Bloomberg Barclays US Aggregate Bond Index is a broad-based benchmark that includes U.S. Treasuries, government-related, and corporate securities.

- For context within broadly balanced portfolios, as most Lake Jericho client portfolios are some balanced average of these various asset classes, the Morningstar, Inc. Moderate Allocation category total return during Q1 was -1.26%. Morningstar, Inc.’s Aggressive Allocation category total return during Q1 was -1.14%. Given the differences in allocations, yet with somewhat similar returns, it is easy to see that in times of heightened market volatility most asset classes do tend to move with a high degree of positive correlation.

Chart 3: U.S. Equity Returns Over Time

The NASDAQ continues to pace the field.

Getting to the specific decisions that influence Lake Jericho client portfolios, I will briefly cover the quarterly results of each of the five levels of our portfolio construction process. As a reminder, no client portfolio will match perfectly target portfolio allocations, sector allocations, or percentages in each, as every client portfolio is unique. Unique factors (portfolio start dates, timing of asset transfers, timing of individual contributions or distributions, overall risk profile, etc.) impact strategic and tactical decisions and the performance attribution of each. However, what follows will generally inform you of the influences upon your portfolio. Clients should carefully review their individual portfolio information to understand how their portfolio is impacted.

International versus U.S. (↑ Contribution)

For Q1, international equity versus U.S. equity strategy decisions versus a market neutral portfolio contributed about 0.03% of additional performance to the typical Lake Jericho client.

Our overweights to international investments, particularly small-company developed market and emerging markets served as a meaningful contributor to client portfolio performance during 2017. The contribution during Q1 was much more subdued, but still positive. Foreign equities remain undervalued in our view, trading at significant discounts to U.S. equities.

On a total return basis the S&P 500® lost 0.76% during Q1, but the rolling one-year total return of 13.99% still bests any reasonable long-term return expectation. The Dow Jones Industrial Average (DJIA), on a total return basis, lost 1.96% during Q1, but remains higher by 19.39% on a rolling one-year basis. The largest Q1 and rolling one-year gains among U.S. diversified funds were among large-company, growth-oriented funds. The NASDAQ Composite Index supports this showing a total return of 2.59% during Q1. On a rolling one-year basis, the NASDAQ continues to outperform with a total return of 20.76%. The rolling one-year results for each of these three major U.S. large-company indexes remain among the best numbers seen in fifteen years, a reminder that keeping a long-term perspective is always best.

The MSCI All-country World Index Ex-US (a measure of large- and mid-sized companies throughout the world’s developed and emerging market economies, excluding US equity securities) finished Q1 largely inline with U.S. counterparts with a total return of -1.18%. The rolling one-year total return was 16.53%. Our foreign, small-sized company exposures fared even better with a positive return of 0.04% for Q1 and a rolling one-year total return of 19.60%. Emerging markets, as measured by Morningstar, Inc. bested all with a Q1 total return of 2.01% and a rolling one-year return of 22.90%.

Bonds versus Stocks (↑ Contribution)

For Q1, bonds versus stocks strategy decisions versus a market neutral portfolio contributed about 0.11% of additional performance to the typical Lake Jericho client.

Interest rates are on the move higher. As long as the move is reasonably paced then that move over time can be deftly managed. Lake Jericho managed portfolios are defensively positioned against the impact of rising interest, in terms of lower allocations to bonds than is considered typical, in how we constrain allocations to equity investments with high negative correlation with interest rates (real estate, utilities, consumer staples, heavily leveraged sectors), and in how we position the bond investments that we do hold. We believe that this defensive position is best in the current environment as yields provide little protection from sudden and large adverse price movements should rates move quickly higher.

While certain elements of our defensive position might not add to portfolio returns in many environments, our positioning provides relatively inexpensive volatility insurance. While our bond positions were a headwind for clients during 2017’s outstanding equity market performance, the way in which we construct exposure was less costly to portfolios than the way in which more traditional managers might implement bond investments. During the volatility of Q1, a period in which bonds provided little cover, our bond construction performed exactly as designed and was a net contributor to positive performance in the typical Lake Jericho managed portfolio.

Small Versus Big (↓ Contribution)

For Q1, small- and mid-sized company strategy decisions versus a market neutral portfolio detracted from performance for the typical Lake Jericho client by about 0.07%.

One of Lake Jericho’s fundamental portfolio convictions is that investors should maintain an exposure to, if not an ongoing overweight towards, small- and mid-sized company equity investments across time. While on average, over the long-run, the space can provide superior investment returns versus large-company peers, much of the excess performance can occur in short, unexpected time periods. We are not in the business of predicting these patterns or trading these patterns, rather we hold as efficient of an exposure to this space as possible over time. This pattern of return, and our persistent holdings, can result in extended periods of underperformance. Our approach to manage this trade off is to employ across time three different strategies, simultaneously, that best expose portfolios to persistent factors of return within the space. This strategy works well across time. However, one of the three strategies embedded in our approach is particularly sensitive to market momentum, and as a result underperformed other small- and mid-sized strategies in the recent downturn.

To fairly evaluate our process in the small versus big category, we look to the Russell 2500 Index for comparisons. The Russell 2500 Index is a broad measure of blended strategies in both small- and mid-sized U.S. company stocks. For Q1, the Russell 2500 Index returned -0.24%, besting the S&P 500® return by 0.52%. Due to the breakdown of the momentum factor during Q1, our strategy somewhat lagged not only the Russell 2500, but also the S&P 500®.

Value versus Growth (↓ Contribution)

For Q1, value versus growth strategy decisions versus a market neutral portfolio detracted from performance for the typical Lake Jericho client by about 0.39%.

As with small- and mid-sized company exposure, Lake Jericho managed portfolios maintain a constant exposure to, and ongoing overweight towards, value-oriented investments. The basic premise of value investing is that certain securities are underpriced bargains and are likely to outperform once their “real value” is fully appreciated by investors. If for no other reason, it is a bit of common sense supported by the statistics that if you remain mindful of not overpaying for your investments then you are more likely to achieve superior returns over the long-run. Value-oriented investing is one method that helps investors achieve this objective. A gross over-simplification of an entire field of financial study, but that is the basic idea.

Like our decisions in the small versus big category, performance patterns in the value versus growth category demonstrate “clumpy” patterns of return. While on average, over long-run periods value-oriented strategies provide superior investment returns versus growth-company peers, extended periods of meaningful underperformance can persist. Leadership does turn, and the relationship normalizes over time.

To fairly represent value versus growth factors in the markets we use Morningstar, Inc. measurements. During Q1, U.S. value funds trailed U.S. growth funds by 6.97%. The rolling one-year difference in total return advantage of U.S. growth funds over U.S. value funds has been 16.01%. That 16% difference is among the greatest spreads in value underperformance in such a compact time frame in measurement history. That degree of performance differential, though rare, certainly feels painful in the short-run. Our strategy and implementation in the space held up well, and we look at the current valuation differences as an opportunity for future outperformance more than as a negative for recent performance. All one need do is look back to 2016, a period in which the spread of value over growth extended to 17.63%, to understand how these patterns reverse in meaningful ways.

Sector Overweight/Underweight Decisions (↑ Contribution)

For Q1, sector overweight/underweight strategy decisions versus a market neutral portfolio contributed about 0.32% of additional performance to the typical Lake Jericho client.

Strategic and tactical sector weighting, the fifth aspect of our portfolio construction process, is an important part of how we add real, long-term value for our clients. Our process of underweighting U.S. equity market-neutral benchmark allocations in favor of overweighting those sectors that we expect to outperform the market average have been a meaningful tailwind for client portfolios over time. Our sector overweights are currently materials, financials via regional banks exposure, and healthcare via medical devices and technology.

- While materials had a rough Q1 due to global macro concerns (finishing down by 5.45%) it has been a strong performer for the last couple of years. We continue to hold the positions due to our continued outlook for global economic expansion and what we expect to be resulting commodity price inflation. Post Q1-end, materials is among the market leaders in terms of recovery for just those reasons.

- While the financial sector generally struggled during Q1 finishing down by 0.98%, our overweight is specific to regional banks which added 2.94% in total return during Q1. We believe that regional banks in the U.S. are best positioned to benefit from a combination of lighter regulation, and higher loan growth rates loan particularly in the energy field as U.S. capacity once again ramps up in response to rising crude prices.

- The healthcare sector generally struggled during Q1 finishing down by 1.29%. Our overweight is specific to the Medical Device and Technology industry sector which provided a 6.64% in total return during Q1.

By necessity, when we apply sector overweights in the U.S. to industries such as materials, regional banks, and medical technology we are as well imbedding underweights to those sectors that we believe will perform poorly in the near term: real estate, utilities, consumer staples, and similar sectors that struggle under inflation and rising interest rates.

Near Term Outlook

Economic and political headlines continue to whip up anxiety like a photo finish between an odds-on favorite and the long shot. No denying that the headlines are cause for concern; monetary tightening by central banks around the world, rising global interest rates, late-cycle fiscal stimulus in the U.S., media pundits volleying around terms like “stagflation”, budget deficits, tariffs, and trade wars. Concern is a natural and expected reaction. But it is too early to be whipping these anxieties across what is still an imaginary finish line. Among our primary measures of economic and market health (global growth, corporate earnings outlook, asset pricing multiples), each indicate that equity markets on average have more room to run.

- The U.S. economy continues to grow, and the full impact of the Tax Cut and Jobs Act of 2017 is expected to enhance the rate of growth in the near term. The injection of two rounds of budgetary stimulus are more difficult to evaluate in the near term. Forecasting the outcome of the U.S. tax cuts and fiscal stimulus measures combined so late in an economic cycle is, frankly, a guessing game. If anyone tells you otherwise, smile politely and change the subject.

- Global economies continue to grow, despite some weak data reported during Q1 that caused concern. Emerging economies are showing particular strength.

- The U.S. Federal Reserve’s plans to slowly increase interest rates has been well communicated and implemented accordingly. The same cadence is being followed by central bankers across the globe. While in the midst of handwringing over rising rates, we should not forget that interest rates remain at historically low levels.

- First quarter corporate earnings are expected to increase 20.0% or more from Q1 2017. Of the companies in the S&P 500 Index that have reported earnings to date for Q1 2018, 79.3% have reported earnings above analyst expectations. This is above the long-term average of 64% above, and also above the prior four quarter average of 72% above. Admittedly, estimates peg 8% of the 20% as a direct consequence of tax-law changes rather than improved corporate performance. But even a significantly reduced earnings growth number still means positive earnings growth, and the ability to grow into the price multiples.

- Equity values might generally be considered stretched, if not expensive. But they are certainly less so than they were at this point last quarter. By the most commonly used measure of value, the trailing price-to-earnings (P/E) multiple, U.S. stocks are at least fully priced. However, if companies can grow corporate earnings 20% in 2018 (like they did in Q1), or even the lower 12% estimated once removing tax implications, then equities appear modestly attractive at that multiple. Sure, certain sectors remain a bit too rich for our taste. Some of the technology sector and the consumer cyclical space is priced more like Millionaire’s Row while we prefer to pay Granstand admission prices. But great value, and winning payouts, are still to be had.

- On the geopolitical front, concerns have increased about tariffs and trade wars. But the smart money is betting that the media circus is more of a stare-down tactic than it is a willingness to tear up the track so no one else can win.

The critical consideration for investors is deciding if this increased volatility is just a normal adjustment in an otherwise healthy market or is it a symptom of something more serious? No denying that we are late in the current economic cycle and that being late-cycle does call for increasing cautiousness. But for each of the concerns listed above, the reality is that the risk is more subdued than the fevered pitch of the crowd indicates. Neither the data, nor market sentiment, support a claim that this record market run is over. At Lake Jericho, we believe the winning strategy from this point forward is to remain in our lane, running our race. If that means that we run the home stretch wearing blinders, so we will not be distracted by the noise and flash of the field, so be it.

We remain watchful and ready to respond should we see signs on the horizon sufficiently impactful to change our near term outlook. As always, I am available at any time, any day of the week, to discuss specific portfolio performance questions. I will also be in touch with each of you in the coming weeks to follow up on Lake Jericho’s rollout of its financial planning platform and capabilities. Until then, be well, enjoy the rest of your week, and thank you!

A.J. Walker, CFA CFP® CIMA®

Founder, President, and CEO

Lake Jericho, LLC