The thing about crafting a useful investment review at each quarter’s end? As each quarter-end approaches I spend a lot of time thinking about the messages most important to reinforce with clients. Then without fail, within days after each quarter-end any manner of hell will break loose that deserves equal coverage. The 4th quarter of 2015 and the 1st week of 2016 are no exception.

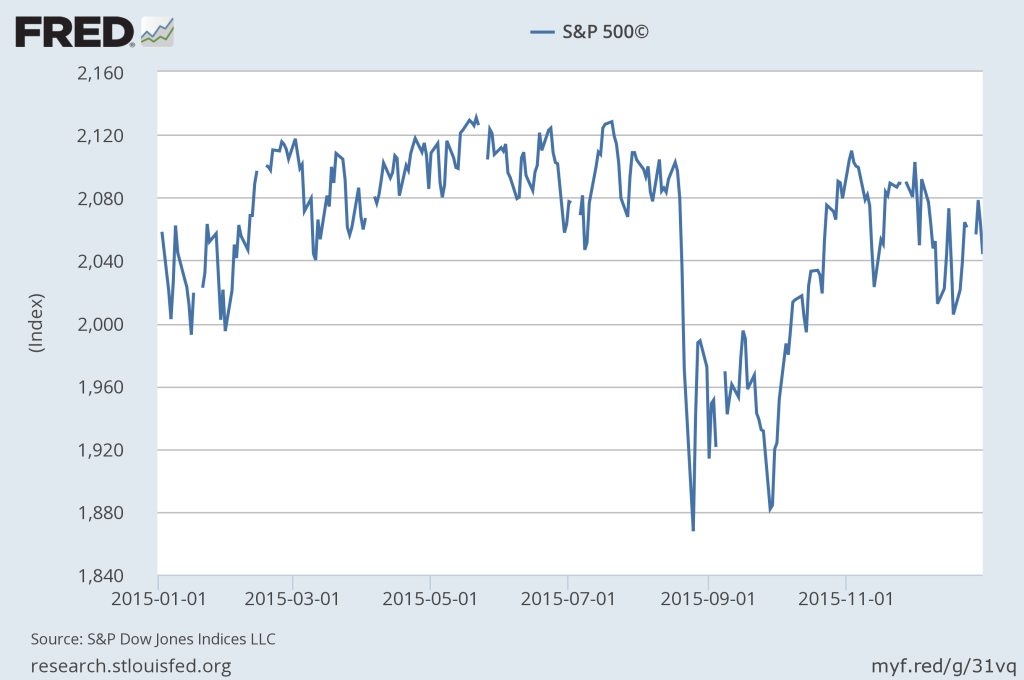

The single, most striking theme during 2015 was that although the U.S. economy continued its pattern of economic recovery, not much in the investment arena worked really well. Although the S&P 500 Index (basically the largest 500 U.S. companies) managed to eek out a modest positive return (1.36%) thanks to stellar returns of a few companies, most asset classes ended the year in negative territory with highly positive correlations. This lock-step movement of asset classes provided few safe havens for investors during 2015. It was a year that reminded us that when we talk about a strategy, or a tactic, that works to our benefit “over time” that it does not mean that it will work to our benefit every year.

A year like 2015 is why we remain committed to a long-term course of action for client portfolios. Every quarter we remind clients that Lake Jericho is an investment firm and not a trading firm, and as such we remain invested in our decisions rather than playing the game of speculation and short-term trading.

As for the past week, I am reasonably certain that by now everyone is aware of the dumpster-fire that was the first week of 2016. The multitude of various sector and style indices aside, the first trading week of 2016 goes into the history books as the worst opening of a new year’s stock market. In the coming years it will no doubt be the subject of much review and ivory-tower analysis. The factors driving the past week are many and complex, but are simply a continuation of the challenges endured throughout most of 2015. Therefore, I choose to roll it all up into the following discussion. I am going to break down just a few of the most important elements that have had the greatest impact on Lake Jericho client portfolios. I will also briefly talk about how these factors impact our strategy for 2016.

- Math.

Last quarter I used a few hundred words to describe how we look at the value of a thing (what an investment is worth to us) versus the market price of that thing (what that investment is worth to someone else). If an investment is of more value to us than the price the market is offering to purchase that investment, then we hold that investment until the market price and our value converge. Many circumstances can cause our value of holding any investment to change over time. But why does the market price of investments change all the time? Simply stated; math. It is a cheeky response, but true.

The market price of an investment is nothing more than a momentary consensus of willing buyers and willing sellers estimation of the future value of a company’s expected cash flows. We take some rate of growth, grow that exponentially over some period of time, multiply that by expected cash flows. Easy breezy. Even if you hate math you know that when you exponentially grow some number that the result grows really quickly. You also know that if you make little changes in numbers grown exponentially (grow 2 by 3 and you get 8, but grow 3 by 3 you get 27, grow 4 by 3 you get 64) your result increases dramatically. Small changes, over time, have big results.

Very simply, this is what is happening with stock prices and why they have been moving so much. Small changes in a company’s earnings, or small changes in growth rates, over time, result in large (exponential) changes in stock price. Some more math (known as discounting) happens in the middle of that, but you get the idea. This idea is fundamental to understanding what is happening in the stock market these days.

Last quarter I suggested that uncertainty is worse for stock markets than certain, but bad news. Uncertainty is driving this market volatility. In the investment arena, there exists a razor-thin line between something being too expensive, and that thing being too cheap. Markets are in perpetual motion trying to maintain equilibrium on the edge of that razor attempting to discern what, based upon corporate earnings and growth rates, is too expensive and what is too cheap.

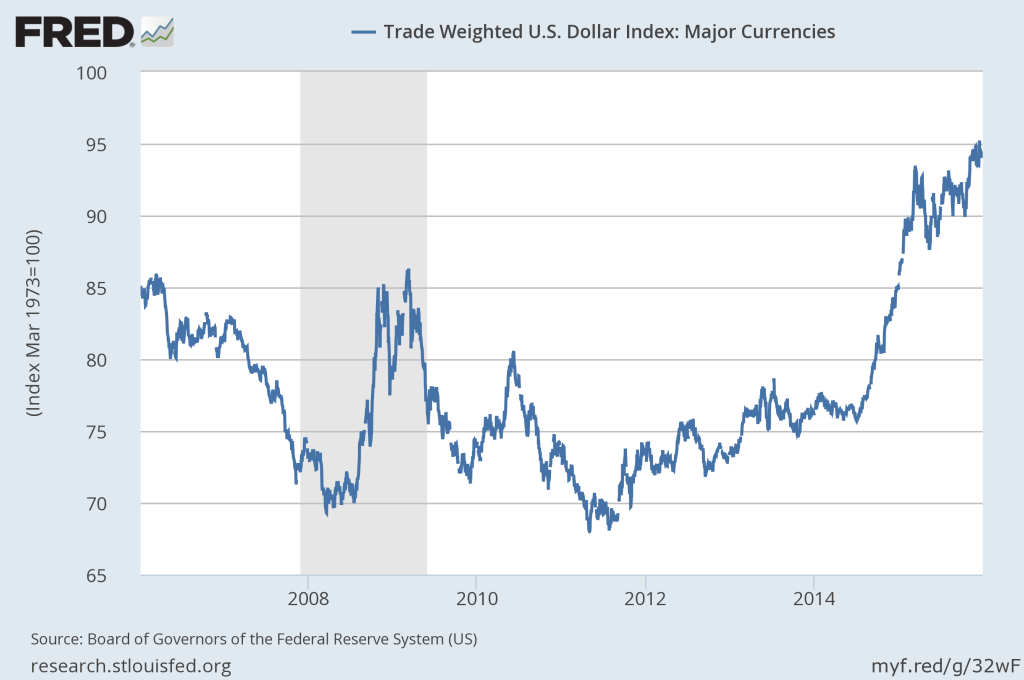

- The U.S. Dollar.

The U.S. Dollar (in relation to other currencies) is an example of something that has become too expensive. One example of the effect is pretty easy to see at work. The second example is more complex. Unless you are an accountant or analyst it is one you likely never think about.

First, a strong dollar is good for U.S. consumers (we can buy more stuff from other countries), but not so good for U.S. businesses (they can not sell as much of their stuff to other countries). So while the consumer-based parts of the U.S. economy are doing well, U.S. businesses that do a large percentage of their business abroad are not doing so well. U.S. companies are earning less internationally.

Second, when a U.S. business generates earnings in foreign markets, those earnings have to be converted back into U.S. dollars for financial reporting and tax purposes. When the value of the U.S. dollar is high relative to foreign currencies, those foreign earnings, simply by exchanging them back into U.S. dollars, are suddenly not worth nearly as much. U.S. companies, already struggling to maintain sales/income in international markets (because their goods and services are now more expensive) are hit with a double-whammy. The earnings that they fought to achieve are simply worth less because of exchange rates.

Both of these examples illuminate the math discussion above; how big changes in corporate earnings (in this example due to the strength of the U.S. dollar) occur in unanticipated ways and how those changes in earnings impact stock prices.

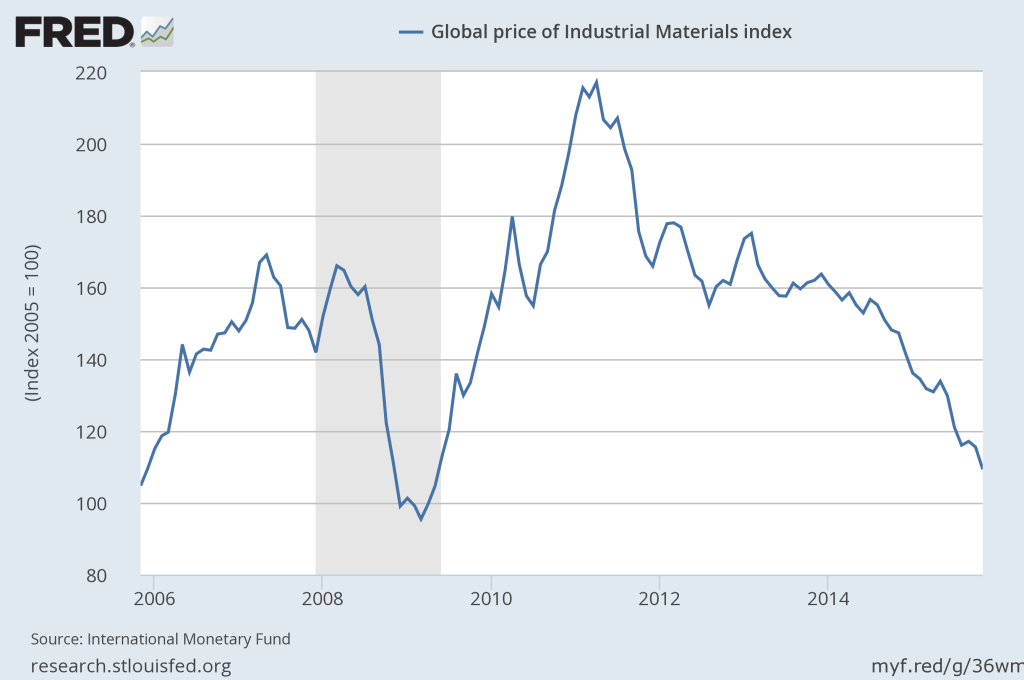

- Stuff that goes into other stuff.

Americans have bemoaned the high cost of gasoline and our lack of energy independence for the last 15 years. The country almost elected a different President because some thought it cost too much to fill up their truck. We have been punching holes in the ground and pumping in fluids to extract so much oil that the U.S. is now an exporter of the stuff. And for the last 25 years the world’s largest mining companies were digging big holes, with big machines, to get tiny, important, rare, expensive stuff out of the ground to help fuel our demand for smaller, faster, cheaper stuff.

Gas is now cheap. Every house has something like 10 bagrillion-inch flat screens TV’s. We all get new phones, tablets, or laptops with every refresh cycle. We love this part of the global slowdown! But if this is so good, then why does it look so bad? It looks bad because there is cheap, and then there is too cheap.

Oil, commodities, and other factors of production have now become too cheap. As a leading indicator of global growth rates, falling prices in the factors of production is interpreted as purely a reflection of demand and therefore a harbinger of slowing global growth. One tangible example of a direct effect is pretty easy to see at work in our daily lives. But when we extend this effect into the markets? The result is more complex, and unless you are an accountant or analyst you do not think about it much.

First, cheap oil and low commodity prices are GREAT for the average U.S. consumer. The money we save due to cheaper energy and lower priced good means that we can save more or buy more. Saving more or buying more must be a good thing, right? In the long run, perhaps. But it takes a long time (and usually a lot of economic pain) to get to a new normal based upon changes in consumption and savings habits. Again, it is about markets in constant motion trying to maintain equilibrium on the edge of the razor.

While cheaper energy and commodities might be good for the average American consumer, the cyclical (business cycle change) or secular (a permanent change) friction upon energy companies (upstream or downstream), mining companies, heavy equipment manufacturers, transportation (railroads, shipping, trucking) companies, has been devastating to earnings. Having made significant investments in capacity for the past couple of decades using assumptions of much higher prices, these companies now have excess capacity and overhead that they can not support. Many companies are being forced to slash production, lay off workers, shutter wells, close mines, and even seek bankruptcy.

In these industries, you are not simply seeing a reduction in the rate of growth. Rather, you are seeing negative growth rates. Negative growth is just an economist’s way of saying “shrinking”. Again with the math, but when you have exponential negative growth, earnings quickly disappear. In short order, debt overwhelms these companies and the assets are forced into liquidation.

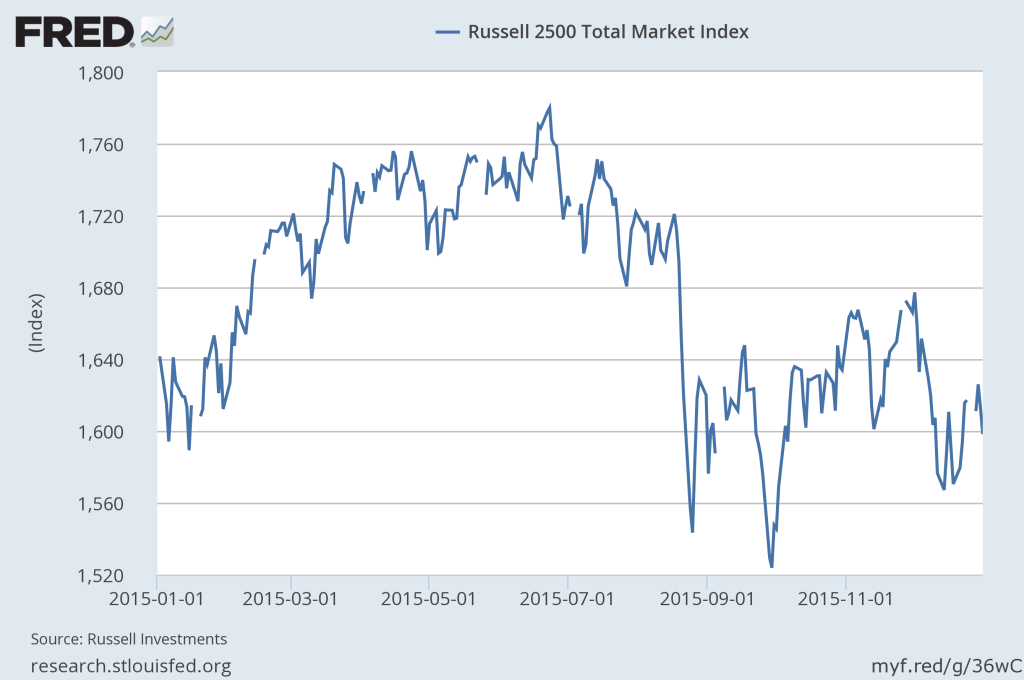

Many companies in these industries are small- and mid-sized companies. The energy, commodities, and materials sectors are a big part of the reason that the small-cap and mid-cap sector indexes (represented below by the Russell 2500 Index) have significantly underperformed big-company stocks during 2015.

Lake Jericho overweights both small- and mid-sized companies in our portfolios. This adds the potential for more price volatility in our portfolios. However, the potential for additional return afforded by this overweighting more than compensates long-term investors for the additional risk. Only during a few, short-term, investment horizons, have small- and mid-sized company investments under-performed large-company only portfolios. 2015 happened to be one of those years. We maintained these overweights throughout 2015 and will continue to do so during 2016.

We did move to purposefully underweight the energy sector in our asset selection throughout the year. However, it is nearly impossible to completely shield a portfolio from the influences as energy permeates every part of our economy. Towards year-end 2015 and into 2016 we have chosen to add additional weight to the materials sector of the U.S. economy as we believe this category should benefit from lower factor costs and recover quickly following recent underperformance. We believe the material sector is likely to be a leading indicator of a larger global turnaround later during 2016.

- New kids on the block.

Our discussion of U.S. Dollar strength and the cost of stuff both feed into the corporate earnings part of our math discussion. What follows is a discussion about the growth part of the discussion.

Developed economies don’t manufacture stuff. Developed economies own stuff, consume stuff, and get served stuff. Emerging economies manufacture stuff in the hopes of earning enough money to also just own, consume, and get served stuff. Frontier economies get plundered for resources but that is another story for another time.

We need not rehash the transformation of the U.S. from a manufacturing economy into a consumer/service-based economy. For a long time, the saying was “as goes the U.S.A., so goes the world” when referring to the engines of economic growth. And we need not rehash the transformation of the Chinese economy from a largely rural and agrarian society into the world’s fastest growing manufacturing economy. That growth transformed China into the world’s second largest economy by 2003. Indeed, that saying can arguably be expanded to “and also as goes China, so goes the world”.

In working with clients, we have spent much of the past three years cautioning others to be mindful of exposure to emerging markets and the Chinese economy. From its founding, Lake Jericho has been thoughtful and purposeful with exposures to emerging markets generally, and China specifically. Emerging market exposure is an important part of a portfolio’s long-term asset allocation. However, we knew that the lofty rates of growth, specifically in China, could not be maintained sustained.

As 2015 progressed we took several steps to either underweight emerging market and China exposures in our portfolios, or have the exposure actively managed by another top-tier firm. We were keenly aware of the tie between European developed markets and China, yet we underestimated the degree to which the Chinese and the U.S. economies are inextricably weaved. Our overweighting of international markets and the inherent exposure to emerging markets, inclusive of China, adversely affected our investment performance for clients during 2015.

China has, rightfully or wrongly, become the idiomatic “Canary in the Coalmine” for global growth. Manufacturing growth? Maybe. But I have a problem with China being the proxy for all global growth. Nonetheless, during the past year manufacturing output data from China has been weakening and investors have interpreted that to mean that economies around the globe must be slowing. Falling energy and commodities prices also were used to foretell of China’s slowing economy.

In my estimation, there is a bit of “cart before the horse” going on. I think that the markets have reacted too strongly to suspect data from the Chinese markets. While it is true that China is slowing, other emerging manufacturing economies are experiencing higher rates of growth (India, Malaysia, Indonesia, Nigeria, Ethiopia, etc.) and are simply producing more stuff now. Only time and more data (which China releases with a great lag) will tell the full story of the secular or cyclical frictions within these evolving economies. Regardless, the result is the current oversold conditions in the markets and the negative impact upon our client portfolios 2015.

- Raising interest rates does not always increase interest rates.

One final thing to touch upon briefly, as it did guide allocation decisions heavily this year, is the non-action of the U.S. Fed for most of the year regarding the normalization of interest rates. With certainty I predicted that the Fed would begin raising rates in the summer of 2015, leading to underperformance of the bond markets versus stocks. When interest rates increase, the prices of bonds fall. At high rates of interest, the price movement does not represent much of the total return from bonds. But in the current environment of low rates, small increases in yield could have a dramatic impact upon the price return of a bond portfolio. This is the reason for our cautious allocation to bonds for most portfolios. And for those portfolios for which we are holding meaningful allocations, we are doing so at very short maturities.

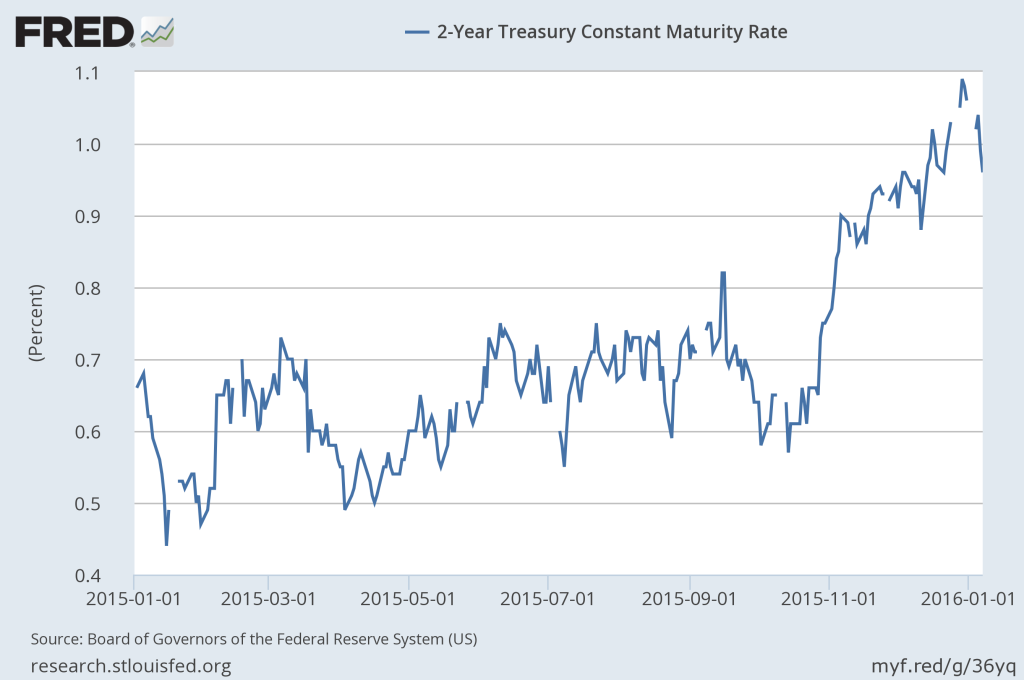

While I stand by my belief that the Fed could have acted in June, they did not do so until December. The chart below demonstrates the yield of the 2-year Treasury Notes (our average maturity for clients) throughout 2015. You will notice that well in advance of the Fed’s move, rates began to climb. As well, you will see (as the chart extends through the first week of 2016) that changes of the Fed’s target rates might not have a long-lasting effect. Yields had already started to fall once again due to a “flight to safety” by many market participants during the past week’s volatility.

Although the returns provided by bonds during 2015 were nothing to cheer about (and in real terms were actually negative when accounting for inflation), bond allocations did protect investors from some degree of the stock market’s move lower. When compared to many advisors, Lake Jericho does maintain lower allocations to traditional bonds and this did adversely affect portfolio performance during 2015. Our underweighting of traditional bonds will continue into 2016. Our continued analysis maintains that an overweighting to equities in the current interest rate environment is the best approach to meet long-term investment objectives for clients.

Trust that we are keeping our eyes on all of the moving pieces across the globe and across the markets. While 2015 did not favor many of our portfolio biases, we remain committed to our strategy for the long haul. The year has just begun. And while January is a fair statistical indicator of the markets direction for the coming year, we will sit tight for the near term. As significant events unfold you can be certain that we will provide updates as needed and advance notice of any deviations in portfolio strategy should market forces warrant them.

Each of you can expect to receive your account-specific quarterly statements in the coming days. We are available at any time and any day to discuss specific portfolio performance. Until then, be well and enjoy the final few hours of your weekend!

A.J. Walker CFP® CIMA®

Founder and Senior Consultant

Lake Jericho, LLC