The thing about crafting a useful Recap at each quarter’s end? When quarter-end is also year-end we have much more ground to cover. And if the combination of quarter-end plus year-end was not sufficiently broad, we also have the U.S. Presidential election to talk about. So I will get to work. My apologies in advance for the coming wall of text.

2016 Annual Review

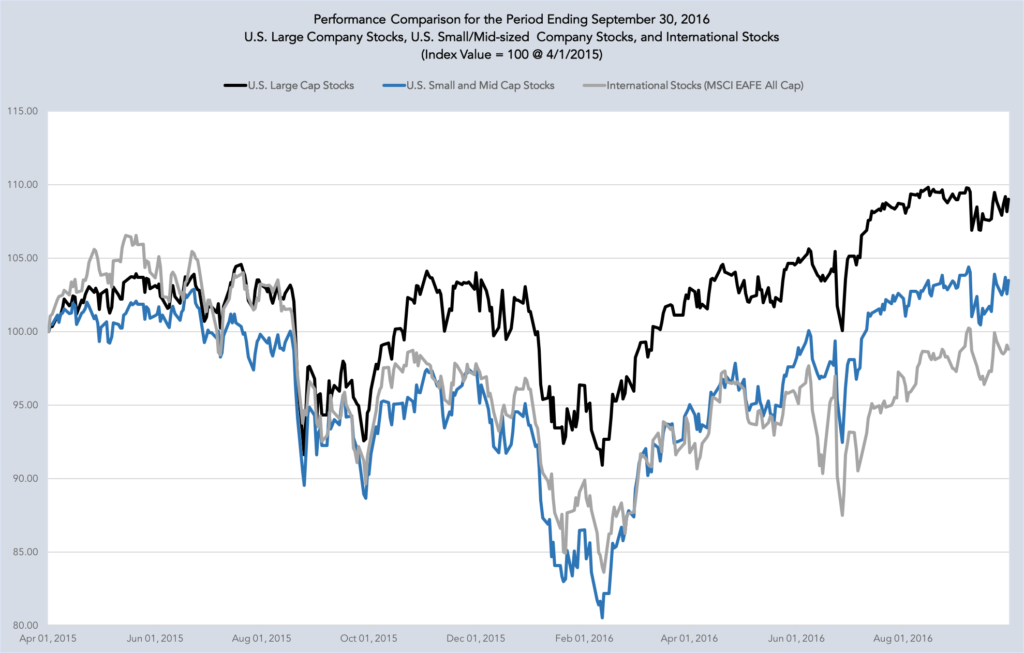

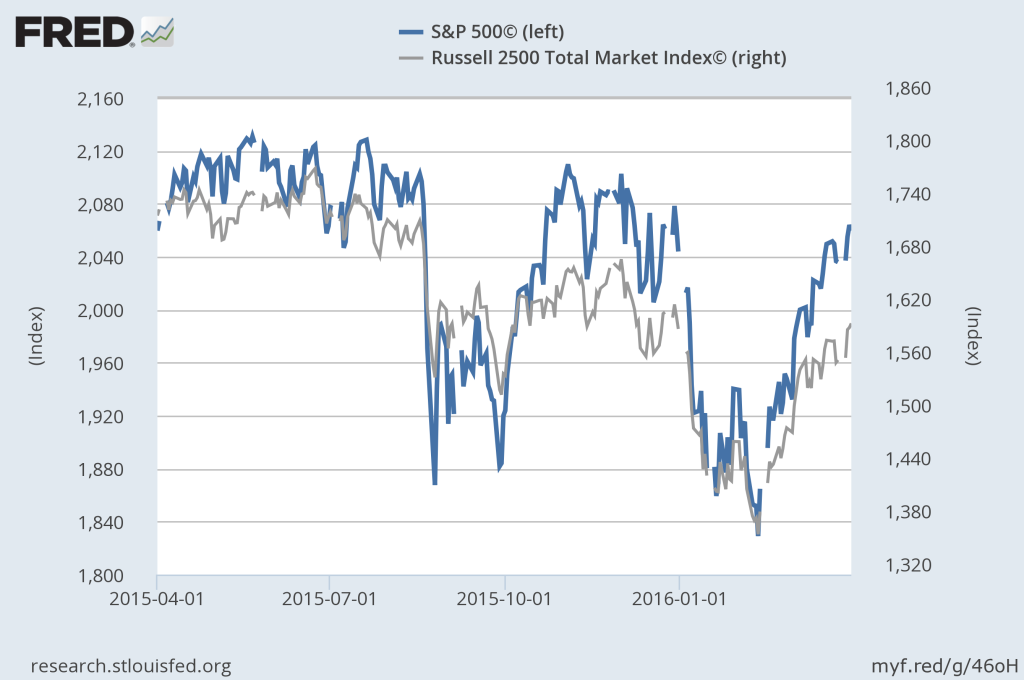

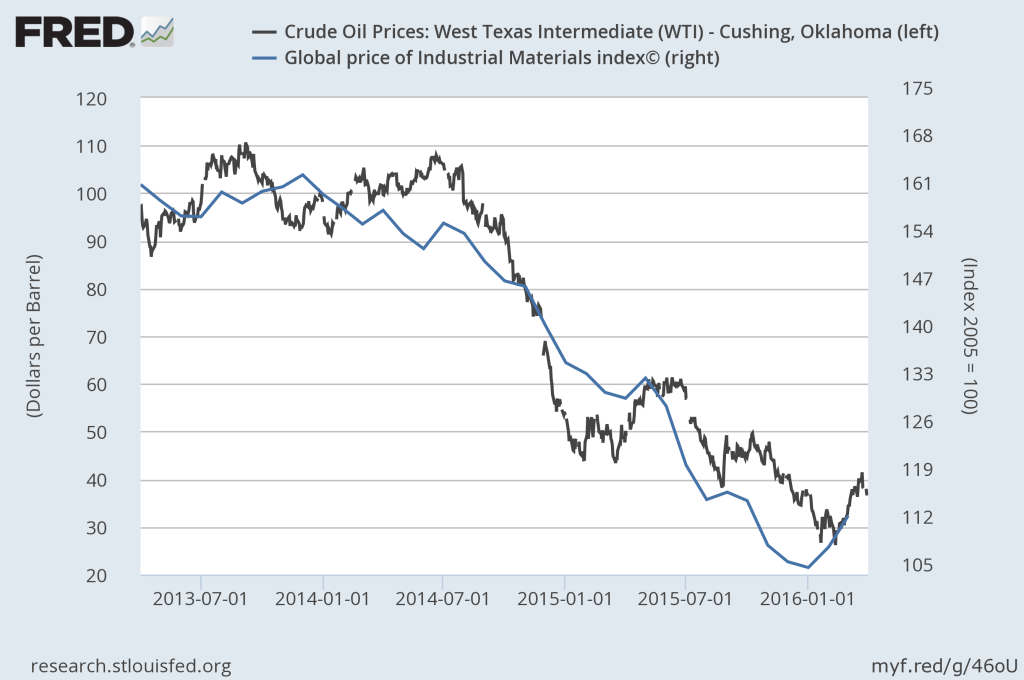

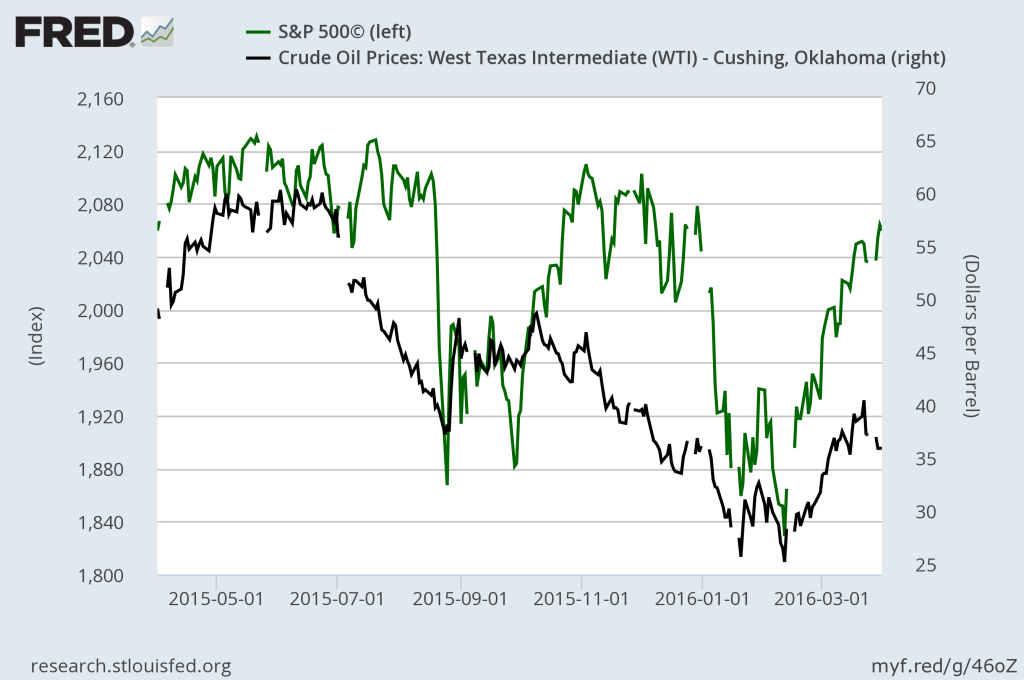

You likely recall that as the year 2015 closed, financial optimists were in short supply with heightened anxiety over China’s economy and stock market, falling global demand for oil and commodities, fears of a potential U.S. recession, and negative interest rates in major world economies. On the first trading day of 2016 the U.S. equity markets began a steep decline creating the worst start of any year on record. The first 10 trading days of the year resulted in the biggest decline, about 8.25%, of the Dow Jones Industrial Average (DJIA) throughout the 120-year history of that index. The S&P 500 index, a far more broad measure of the market, fell about 8% in the first 10 trading days. Results in early January appeared to confirm the most pessimistic of views as markets around the world, seemingly in sympathy, fell sharply. Not one of the nine investment strategists participating in the Barron’s 2016 Roundtable expected an above-average year for stocks. In fact, six expected U.S. stock market returns to be flat or negative, while the remaining three predicted low single digit returns at best. Prospects for global markets appeared no better, according to this group. Two panelists were sufficiently bearish to recommend outright betting against emerging markets. Then things got worse.

Oil prices fell sharply. Worries about an economic debacle in China dominated the news cycle. Stock markets in France, Japan, and the UK registered losses of more than 20% from their previous peaks. Plunging share prices for leading banks around the globe had many worried that another financial crisis was brewing. By the time U.S. stock prices hit their bottom on February 11, shares of the five largest U.S. banks where down 23%.

U.S. markets began improving in mid-February and continued that pace through midyear, just in time for investors to then face uncertainty from June’s Brexit vote. While stock prices had generally recovered, as late as June 28th the S&P 500 Index was still showing a year-to-date loss. Throughout the year, observers fretted a lagging pace of U.S. economic recovery. The New York Times reported that “weighed down by anemic business spending, overstocked factories and warehouses, and a surprisingly weak housing sector, the American economy barely improved…”. A number of well-regarded professional investors argued that the next economic downturn was fast approaching while one prominent activist predicted a “day of reckoning” for the US stock market encouraging investors to “sell everything”, to “get out of the stock market.” As late as August a prominent Hedge Fund managed announced a doubling of his downside bet against the S&P 500 Index. It would appear that well-regarded predictions are worth exactly what one pays for them.

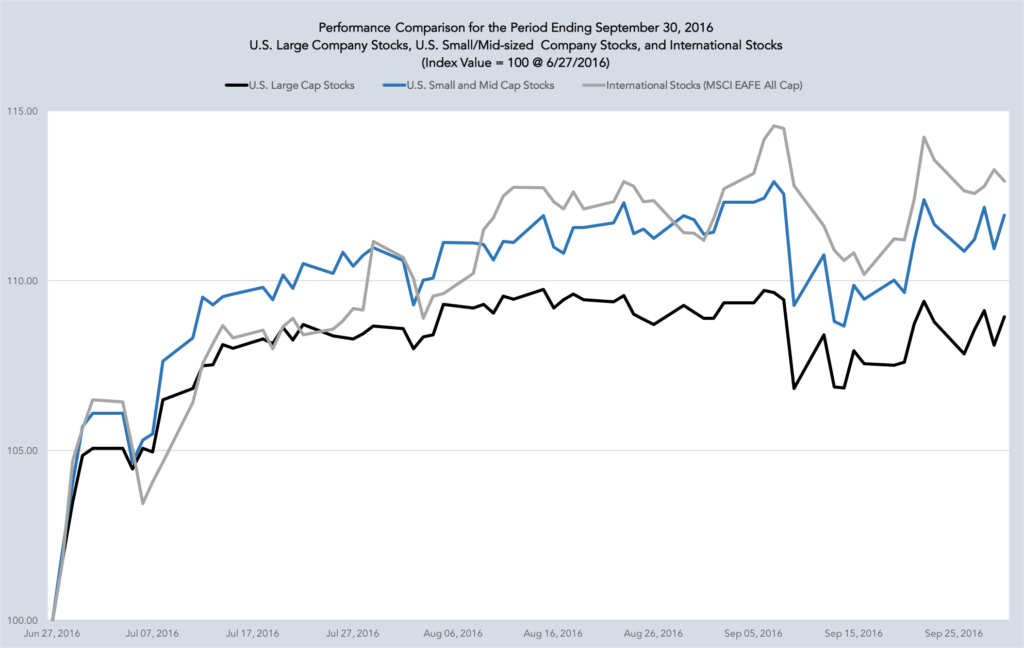

Despite the dire predictions, equity markets around the globe staged a nice comeback throughout Q3. Aside from a few industry sectors that got continuously caught up as fodder for bi-partisan vote-pandering during the U.S. election cycle, it was a very good quarter for investors. Each new bit of economic data implied an improving U.S. economy and employment market. Stabilizing oil prices and corporate earnings helped turn the market around prior to the later-days of Q3.

Q4 Review

After highlighting the good news that Q3 brought for Lake Jericho clients, when closing the Q3 Recap we highlighted our strategy to manage increased volatility (to the down side) leading up to the actual election. The increased volatility call was an easy call, no doubt, as most investors tend to sit on the sidelines in advance of big economic or political events. When investors are sitting on the sidelines, not bidding up prices on new investments, stock prices will fall. That is exactly what happened in the weeks after the end of Q3 leading up to election day, a period in which the S&P 500 Index gave back about 2% of its year-to-date gain. Then came the new elephant in the room.

Putting aside personal biases, we believed for some time that Donald Trump would win the Presidential election. While correct about the election outcome, along with many others we were surprised about the short-term market impact. Well, we were for a few hours. But then we was not. Either way, we decided well in advance of the election to more neutrally construct risk exposures in client portfolios. That is just a fancy way of saying that we hedged our bets. We positioned portfolios to mitigate some measure of the downside risk associated with either candidate’s victory even though it meant that we would forego some of the upside potential represented by each candidate.

On election night, as early results began to indicate a likely Trump victory, global markets and the U.S. futures markets (think pre-opening indication of where markets are going that day) went into a tailspin. Near midnight in the U.S. the futures market for the S&P 500 Index and DJIA had both fallen by more than 4%. Not unlike 2016’s surprise Brexit vote results, stocks tumbled on the unexpected outcome (unexpected based upon polling data at least). To repeat one of our most often stated market realities; uncertainty is worse for stock markets than certain, but bad news. While futures markets remained in chaos through much of that night, by morning, after Trump was declared the winner, investors shifted focus from unexpected election outcomes and policy uncertainty to a unified, seemingly instantaneous expectation that his plans for higher government spending, lower taxes and fewer regulations will create more economic growth, higher inflation and, potentially, rising corporate profits. This, to us, is where a disconnect occurred between markets and realistic expectations of what a Trump administration might bring. Our internal view is that markets have put the cart well before the horse.

Within a very short window of time, post-election markets priced to perfection flawless policy execution. Implying no value judgement on policy positions themselves, the immediate repricing of market as if the Trump administration would be able to immediately and fully institute those policies is a disconnect from the administrative reality of how the U.S. government functions. Donald Trump is many things, a remarkable showman for one, but a monarch ruling in a vacuum he is not. While he has much common ground with the GOP leadership in both houses of Congress, there are many challenges ahead to crafting mutually agreeable paths to achieve many shared goals. In many respects, such as the budget deficit impacts of increased fiscal spending, Trump’s vision of some policy matters are further removed from political reality than those faced by Barack Obama and GOP leadership.

Be that as it may, the result of the November election provided a kick that drove markets to new highs before settling slightly below those highs at year-end. The S&P 500 Index finished the year up 9.5% on a price-return basis (11.96% total return basis), an impressive 20% swing from the market lows in February. For Q4, the S&P 500 Index finished up 3.25%, essentially matching the Q3 2016 return of 3.31%, but about half of the Q4 2015 return of 6.45%. So is it true that the markets love Donald Trump? Maybe. Maybe not. Some sectors have been big winners since the election, while others have not fared well at all. Although there have been a few eye-popping headline numbers, the market rally has not been as widespread as those headlines imply. This is why we prefer to think of the post-election market as getting more of a Trump-bump than a Trump-rally. At Lake Jericho we spend a great deal of time helping investors look beyond the headline numbers to better understand what is happening in the market and in their portfolios. To understand why the post-election rally is not a clear-cut as the headlines make it appear, it is important to look at some specific sectors and styles.

Sector & Style Reviews

- The Dirty Economy: Oil drillers, gas pipelines, coal, construction and industrial equipment, infrastructure, defense, and materials are all post-election winners . The Trump administration could take the lid off coal and fracking regulations, begin an extensive repair of the nation’s roads and bridges, and rebuild defense. Each of these are generally considered pro-growth, pro-inflation measures and the markets priced these possibilities fully into the post-election rally. Again, some of these are particular areas in which Trump will likely be fighting the establishment GOP when budget and deficit realities work their way into the discussions. Unless Paul Ryan and his budget committee experience a reversal in their long-communicated austerity position, many of these projects are likely to be the subject of long, protracted budget battles should they materialize at all. Our approach to this space throughout 2016 has been through portfolio overweights to the Materials sector. During 2016 the Materials sector bested the S&P 500 Index total return by nearly 10%, providing a significant tailwind for client portfolio performance.

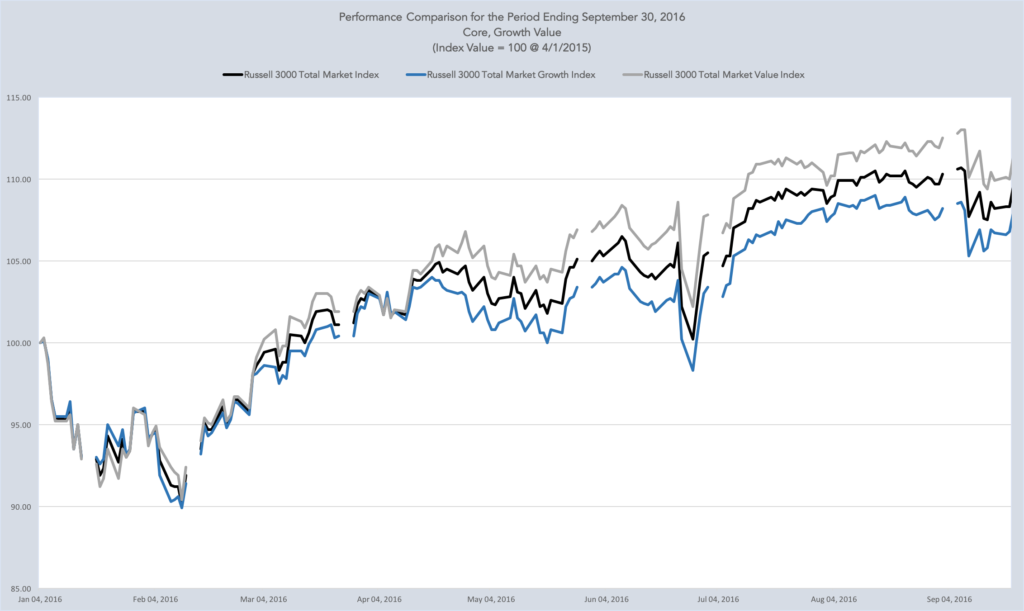

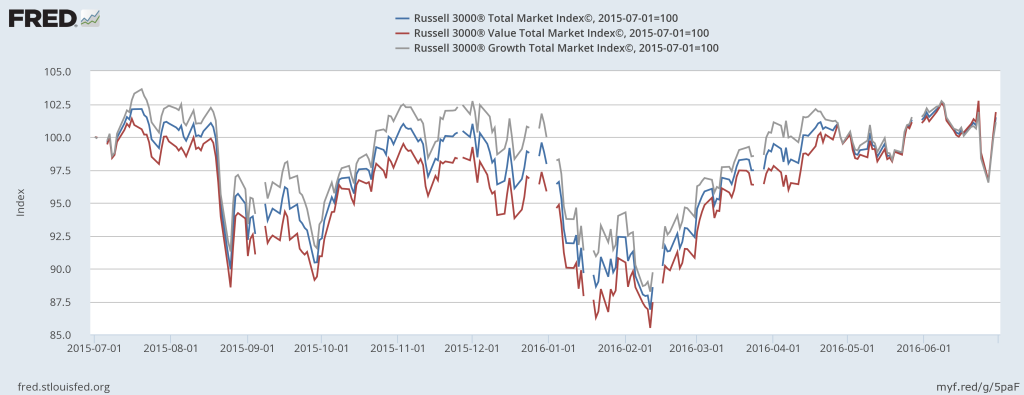

- Value Bias: We regularly discuss Lake Jericho’s “value” bias investment style, versus a “growth” oriented investment style. We use the term “bias” purposefully, as we are not a pure value investor, rather we tend to more heavily weight value-oriented investments more than the style itself represents in the U.S. equity market. During the past several years, particularly during 2015, stock market increases were driven in part by investor enthusiasm for fast-growing companies (“growth” oriented companies) with marginal, even no, profits. Many value-oriented strategies (which seek to buy and hold profitable businesses when they are trading at discounts to intrinsic value) did not fully participate in the market’s returns. This was part of the reason that some Lake Jericho portfolios underperformed the broader markets during 2015. However, as we regularly reinforce, when these types of environments persisted in the past they consistently ended with big rewards for value-oriented investors maintaining their discipline through the cycle. 2016 in total, and particularly post-election 2016, was a validation of this discipline. Each of the sectors discussed above (banking, financial services, infrastructure, industrials, and defense) have been considered “value” investments for a number of years.

Shifting benchmarks a bit (merely because Morningstar, Inc. does a better job of quantifying value/core/growth style performance differences), Morningstar reports that while a 100% U.S. large-company, core portfolio returned 13.75% for 2016, its value-oriented counterpart returned 18.91% while its growth oriented counterpart returned a meager 1.79%. These performance differences between value/growth styles become even more pronounced as one moves down in company size through mid-cap and into small-company stocks. These combinations of style bias provided a significant tailwind for client returns.

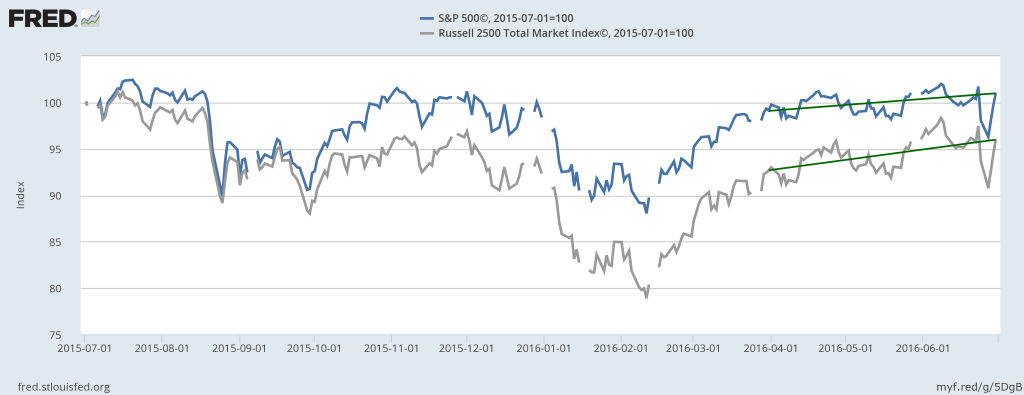

- Small Company Bias: Small-company stocks tend to be more economically sensitive. Economic data has been strong the last two quarters. With the election over, Wall Street finally seems to finally be paying attention to our improving economy, and the potential impact of Trump positions on smaller U.S. firms. Investors are betting that a Trump administration will focus on policy changes positive for the U.S. economy but less so for the global economy. Since small-company stocks generate a larger portion of their revenue in the U.S., small-company earnings will be less affected by potential negative ramifications in foreign markets. Also, if Trump and a Republican-controlled Congress lower domestic corporate income taxes as many predict, small companies will benefit most. Further, large companies with a major international footprint could be adversely affected when Trump seeks to renegotiate global trade agreements. They could even find themselves subject to additional penalties if new laws are enacted adversely impacting companies that operate abroad and import products back into the U.S. market. Rising interest rates have already caused the U.S. dollar to strengthen, another headwind for large companies with global operations. Small companies operating exclusively in the U.S. avoid this problem.

In the weeks following the election, the Russell 2000 Index (a commonly used index for U.S. small-company stocks) gained 16.14% from the pre-election close to a new high-water mark. Although the Russell 2000 Index would give back about 2.25% before year-end, the spread in performance between small-company stocks and large-company stocks post-election was the widest it has been in about 14 years. Our approach to small-company investing bested the S&P 500 Index by nearly 15.00% during 2016. This excess performance combined with the fact that we overweight small- and mid-sized company stocks provided significant tailwinds for client portfolios during the year.

- The Rolling Tech-Wreck: On the opposite end of the spectrum, the Technology sector (the biggest sector of our economy by market capitalization) was a complete wreck post-election. In fact, 2016 has been filled with mini-cycles within the various sub-sectors of Tech. Post-election, anything tech related was considered to have a giant target on its back for the industry’s nearly absolute support of the Clinton candidacy. Significant concerns loom in the background over whether Trump will expand the government’s surveillance powers and attempt to weaken security and encryption. Trump vowed to “penetrate the Internet” to prevent ISIS from using it to recruit fighters. He chastised Apple for refusing to create a back door that would let the FBI unlock an iPhone used by the attackers in San Bernardino, Calif. Each bit of rhetoric has sent chills through Silicon Valley and prompted a flood of responses from engineers and big company leadership. Reservations exist about staffing as during the campaign Trump attacked the H-1B visas program for high-skilled immigrants, only to walk back the statement in private conversation. During the campaign, many feared that Trump would serve to stifle competition via FCC appointments only to have him make later comments that were pro-competition. His campaign’s only policy adviser, Stephen Miller, seemed uninterested in tech and made little outreach to the industry. Lobbyists and officials from tech giants beaten down in the post-election market said they would need to watch closely for clues to Trump’s tech policies. But in fairness to the Trump administration, the difficulty expressed by many companies to know how Trump would act is largely because they had not had any contact with the Trump campaign. And some Silicon Valley investors and entrepreneurs acknowledged that he could be more friendly to business than Clinton, opening up some opportunities for start-ups in emerging areas, such as financial technology and the gig economy. Overall, the Trump campaign has said very little in absolute terms about issues affecting the tech industry and instead focused largely on manufacturing. In the end, client portfolios that were overweight to technology sub-sectors (such as cloud infrastructure and semi-conductors) did well during 2016 as the sector slightly outperformed the overall S&P 500 Index. But post-election and heading into the new year the sector dramatically underperformed the broader market. This is a space that appears to be stretched in valuation and is a space we consider to be a bit of a challenge for 2017.

- Healthcare: The healthcare sector presents, currently, a confounding challenge. Fundamentally speaking, valuations are attractive across the sector. There are many great companies, doing great work, and achieving wonderful results. There are also some knuckleheads that can’t keep themselves out of the news for tone-deaf business strategies. While for 2016 the “healthcare” sector was the worse performing S&P 500 market sector, our portfolio overweights to the medical devices and technology sub-sector provided marvelous results for client portfolios. Unfortunately, portfolios with additional allocations to pharmaceuticals, and/or biotechnology, struggled to keep pace. During the presidential campaign, Clinton was often critical of the pharmaceutical industry when it was likely more appropriate to focus on specific companies and their pricing policies. It appeared that the market is incapable of differentiating between pharmaceutical companies and biotechnology companies so both sub-sectors would get taken to the woodshed. Her defeat suggested that the regulatory environment for drugmakers and research companies could be more lenient than many expected before the election. Not surprisingly, post-election the drugmakers did very well, although at the time it was more about what Trump had not said than what he had. Biotech and pharmaceutical stocks swung up sharply the day after the election and continued to climb for about a week. But then one prominent drug-company CEO noted in a speech that drug prices were a populist issue, implying that investors were getting ahead of themselves thinking Trump will leave companies alone. Days later, Time magazine published an interview with Trump in which he said he was “going to bring down drug prices”, a position he reiterated in a post-election news conference and in interviews. Sharp declines resulted.

In fact, Trump is not really seen as good news for anything in the healthcare space. His plan to unravel the Affordable Care Act has hit some healthcare stocks very hard. With the ACA unlikely to survive in its present form under a Trump administration, the future health insurance of some 20 million Americans is uncertain. If Congress and the incoming president roll back the ACA’s subsidized individual insurance exchanges and Medicaid expansion, many of those 20 million Americans insured under those provisions could lose coverage. Millions of potential patients for doctors would no longer be able to afford healthcare, and markets appear to think that could mean lost business for hospitals, medical service companies, medical technology, and even firms focused on R&D. Whatever the GOP “repeal and replace” plan might look like, it must be a comprehensive measure to soothe market fears about this crucial segment of the economy. This is the confounding part of the sector; attractive valuations with otherwise attractive prospects but subject to the greatest political risks in recent memory.

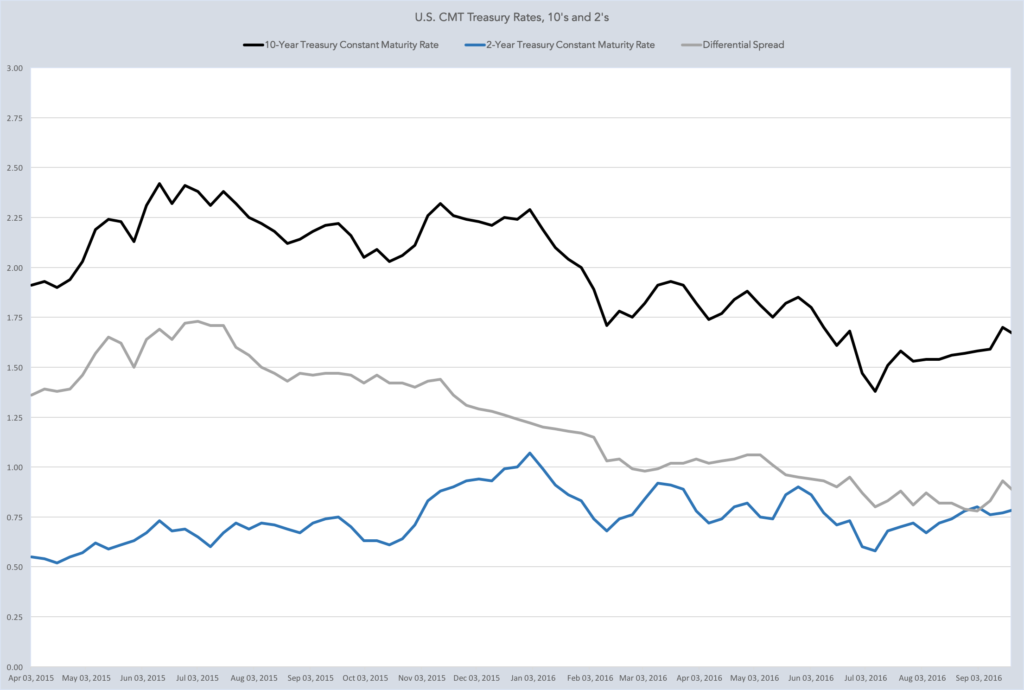

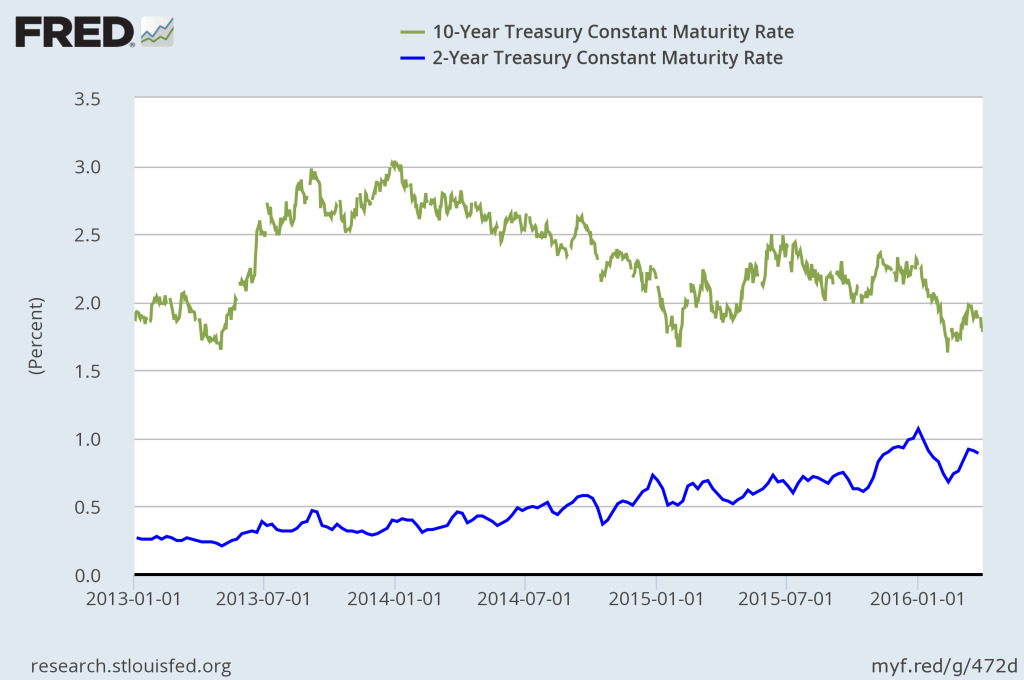

- Interest Rates, Currencies, and International Markets: It should be no surprise to any Lake Jericho client that our typical portfolio will have significant allocations to international investments, both stocks and bonds. This past year in international investments is a bit difficult to get one’s head around without some discussion of currency values and interest rates. They are all connected in complex ways, but I can break down the complex relationship in one dangerously over-simplified, run-on sentence — When country A has a higher rate of inflation than country B, then country A will also have higher interest rates than country B, and those higher interest rates will incentivize investors to sell investments held in country B, use the proceeds to buy country A’s currency that they then use to buy investments in country A. That is the dynamic in post-election U.S., a bit of “which came first, the chicken or the egg” dynamic. But they are all countervailing forces at work against one another as they seek some long term equilibrium. Using this pattern (assuming that we are in a virtuous inflationary cycle rather than a destructive inflationary cycle) we can discuss how these moving parts are affecting client portfolios.

A number of Trump’s pro-growth items will demand much higher government spending (fiscal policy) to achieve. Expansionary fiscal policy is necessarily inflationary (growth=inflation). That is the whole point. Meanwhile, restrictive trade policies that make imported goods more expensive for American consumers, or a crackdown on immigration (possible labor shortage) would most likely also lead to higher inflation. Two things happen in an growth/inflationary period; (1) stock prices rise because stock investors assume corporations will earn more, and (2) bond prices fall because bond investors demand higher yields to protect them from inflation. Suddenly, the U.S. stock market and the U.S. bond market look much more attractive to the world’s investors. To capture the higher returns/yields available in the U.S., international investors start buying the U.S. dollar so they can make new investments in U.S. securities. Suddenly, again, you have a much stronger U.S. dollar, higher U.S. investment values, and lessened demand for international securities.

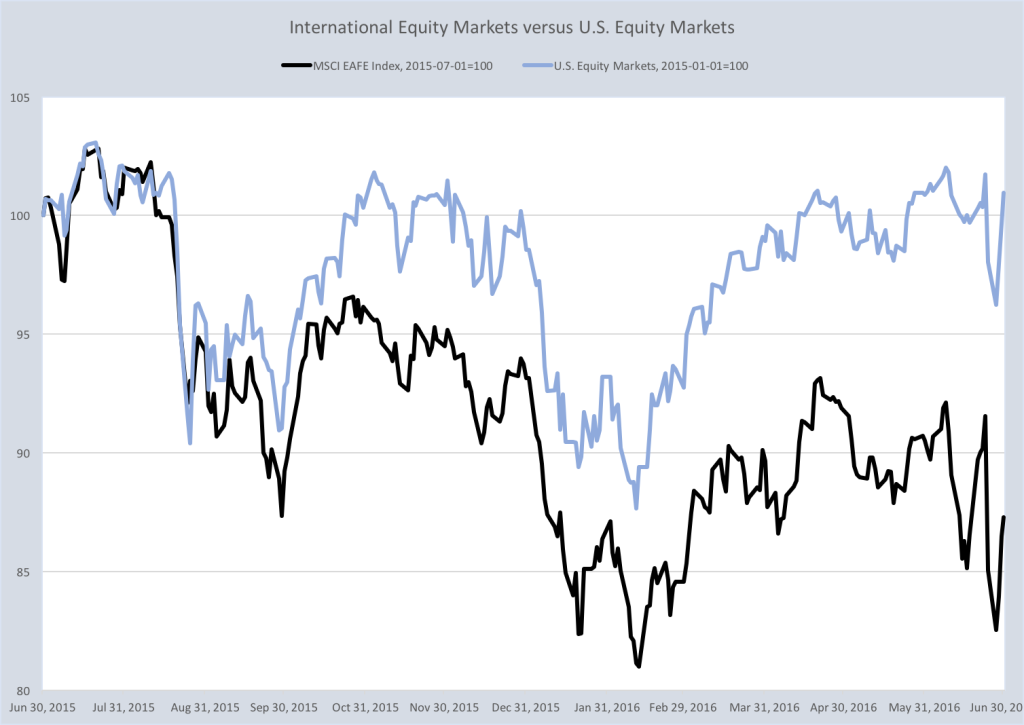

In local currency terms, equity performance in many international markets was stellar during Q4. Eurozone equities were stronger over the quarter, with the MSCI EMU index returning 8.1%. In the UK, even in the face of a looming hard BREXIT, the FTSE All-Share index rose 3.9% over the period. The Japanese equity market rose each month in the quarter to produce a strong total return of +15.0%. However, when one accounts for the affects of the strong U.S. dollar on currency adjusted returns, these areas of excess performance are much more muted and in some settings the currency affect resulted in negative returns. For example, the unhedged MSCI EAFE (Euro, Australasia, Far East) Index gained just 1.5% with dividends, or 10.5% less than its U.S. counterpart, the S&P 500 Index. Aware of this heightened risk, Lake Jericho executes our international allocations using multiple strategies. In some situations currency exposure is unhedged, while in others the exposures might be partially or even fully hedged. Regardless, on average our higher-than-typical international allocation was a drag on client portfolio performance during 2016. Our mix of strategies did result in net gains for clients for the year, but the return did lag the broad U.S. market.

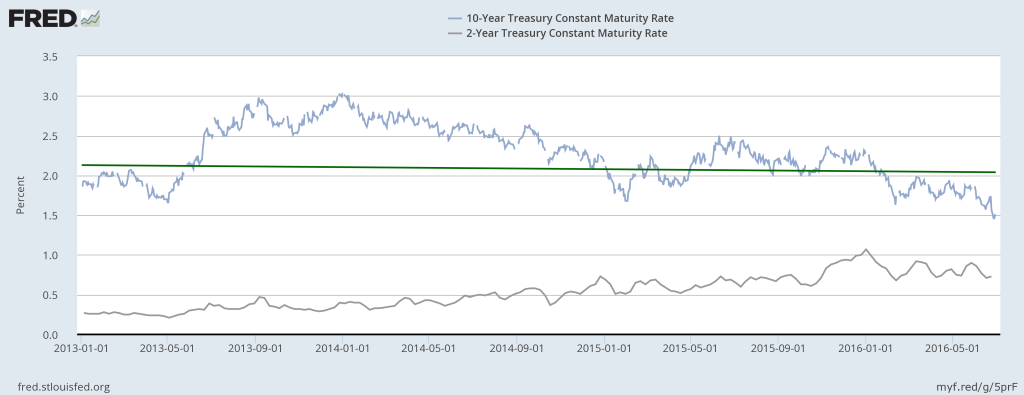

- Interest Rates and Bonds: Without diving into the specifics, one can view bond markets as a mirror for growth expectations. Despite the volatility in both the domestic and the global bond markets, expectations for global economic growth tentatively grew more optimistic during Q4. It appears that others are beginning to increase their global growth outlooks and are now more in-line with the expectations that we have had internally for about 18 months. We were correct in our Q4 Outlook that the U.S. economy was on sure enough footing that the Federal Reserve’s FOMC would take the next step in rate normalization. Of course, we actually believe that they should have taken that step at least four times by now. So it isn’t that we think we are smarter than other folks, rather we tend to embrace the data in our decision-making earlier than other folks.

For much of the year, we have talked about how our lower-duration bond portfolios lagged the returns of the broad bond market as long-term interest rates continued to fall. Our preference to use domestic bond allocation as a ready source of liquidity and as dampener of stock volatility means that we are not chasing returns from longer duration bonds. Anticipating the affects of rising interest rates was as much of a reason as well. As previously stated, during Q4 bond yields moved higher and the yield curves steepened much as we had anticipated for much of the year. As the tides turned, post-election, and rates rose quickly, our bond portfolios held up much better than the broad bond market. In the end we were able to provide lower volatility and higher returns for clients than traditional long-duration bond funds for 2016.

Like domestic bond markets, global bond market movements were overwhelmingly driven by political factors. At the forefront of the political dynamics stood the victory of Donald Trump, but upcoming elections in Europe also rose in prominence as potentially destabilizing influences. The uncertainty surrounding the UK’s negotiations to withdraw from the European Union also impacted bond portfolios significantly. Some level of global bond exposure is standard for Lake Jericho managed portfolios. Not surprisingly, it is also an allocation that we use differently than most managers. As such, while most global bond allocations disappointed during Q4, our allocations bested broad market bond indices by nearly 11%, and even beat the S&P 500 Index by more than a full percentage point.

So what does all of this mean for us going into this new year? The Trump-bump has left stocks historically expensive relative to their intrinsic valuations. The Shiller Price-to-Earnings Ratio is a commonly used, though not without flaws and limits, measure of how expensive stocks are relative to their intrinsic values. It shows the ratio of S&P 500 Index company stock prices to their earnings, after adjusting for a set of macroeconomic factors. As 2016 closed, the Shiller Ratio was 28.8. The only times the Shiller Ratio has been higher were right before the 1929 crash, the dot-com bubble of the late 1990s, and the run-up to the 2008 financial crisis. I am NOT implying that a stock market crash is imminent. I am NOT implying an abiding faith in the Shiller Ratio. It is NOT even part of the set of metrics that we use internally. All I am saying is that stocks have generally gotten very pricey lately and most popular, independent, simple measurements do tend to agree. It creates an uncomfortable time to make new investments for a value-biased firm like Lake Jericho.

This is also a bit of a double-edged sword for us and our clients. While existing investments enjoyed a nice run-up in value, it has become increasingly difficult to get cash positions and new deposits invested. We suspected that there will be a period of downward pressure on markets after the December FOMA meeting through the end of the year and perhaps into the new year’s earnings reporting season. This did happen and created a few opportunities for us to get the majority of cash and new deposits invested. As for the remaining cash, new deposits, and the remaining inverse positions we hold, we remain constantly on watch and are being very careful about allocation and timing decisions of new investments.

Generally speaking, we are continuing with our long-term global economic growth estimates for both domestic and international markets. Our targets, generally, remain the same as those we have held for the past year with higher expectations for both foreign developed and emerging markets than for the U.S. market. As such, we will maintain our healthy allocations to international investments, less so despite the period of underperformance but more so because the period of underperformance leaves international investments as one of the few places where valuations remain attractive. For the near term we are expecting reduced market volatility. We are not alone. A wait-and-see attitude persists in the markets right now, a breather as it were, to see exactly how fast, or slow, or how much of the Trump agenda might materialize. We suspect that any hiccups along the way will have immediate impacts upon securities prices.

Most importantly, we are still formulating our sector strategies for 2017. We typically have these matters settled and executed by this point in the new year. However, the Trump presidency (more specifically the Twitter presidency) has added additional complexities that we are still sorting out how to properly evaluate and manage. In a time when a single Tweet can send an entire industry group into a tailspin, we are revisiting some aspects governing how “long-term” our sector outlooks and strategies should rightly be. As is typical, a more simple framework of embracing sensible asset allocation and broad diversification is likely the best strategy in what could be a more volatile environment. In the final analysis it is possible that for some time we will simply be more “core” focused than in the past in the hope that the Twitter-in-Chief settles more calmly into his new role. As 2016 closed, the U.S. market reached new highs, and stocks in a majority of developed and emerging market countries delivered positive returns for the year. The 2016 turnaround story highlights the enduring importance of diversifying across asset groups and regional markets, as well as staying disciplined despite uncertainty. Although not all asset classes had positive returns, most broadly diversified portfolios logged attractive returns in 2016, a reality most could not imagine early during the year. Maybe 2017 will be just like that.

We are available at any time, any day of the week, to discuss specific portfolio and performance questions that you might have. I will also be in touch with each of you in the coming weeks to discuss any changes in strategy that should be considered, or to walk through any administrative tasks that might be needed. Until then, be well, enjoy the rest of your week, and thank you!

A.J. Walker, CFA CFP® CIMA®

Founder and Senior Consultant

Lake Jericho, LLC