Along with the end of Q2, the first half of 2017 has come to a close. An elementary observation, of course. Nonetheless, it has been tough for me to wrap my head around this reality. To look at my calendar and see that we are moving into August is befuddling to my perception of time. Yes, the timing of the July 4th holiday pushed back most of the street’s reporting cycles, and I am as well behind my typical schedule in posting this commentary. Most likely, perhaps, I am disoriented because 2017 has been packed with distraction, but somewhat devoid of negative investment catalysts. Despite the constant noisy-gong and clanging-cymbal drama arising from our nation’s capital, the lack of any pro-growth policy progress from the White House, and a Congress recently called the least effective in 164 years, little of consequential market impact has been integrated into public consciousness. While the news cycle is 100% hyperbole, 100% of the time, professional investors seem to have turned away from Washington’s, and the media’s, inflammatory rhetoric and instead refocused itself on old-school, fundamental macro-economic analysis and corporate valuation work.

Q2 Recap

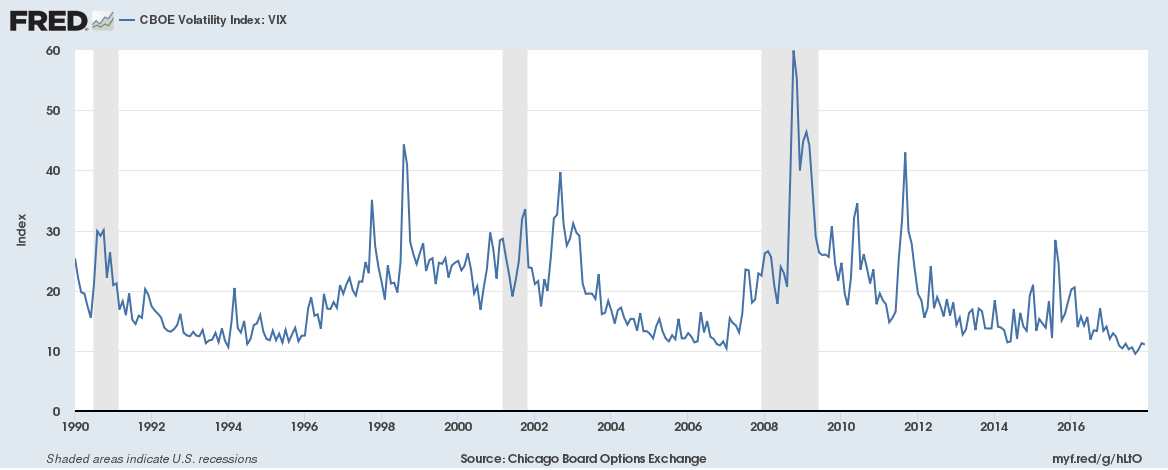

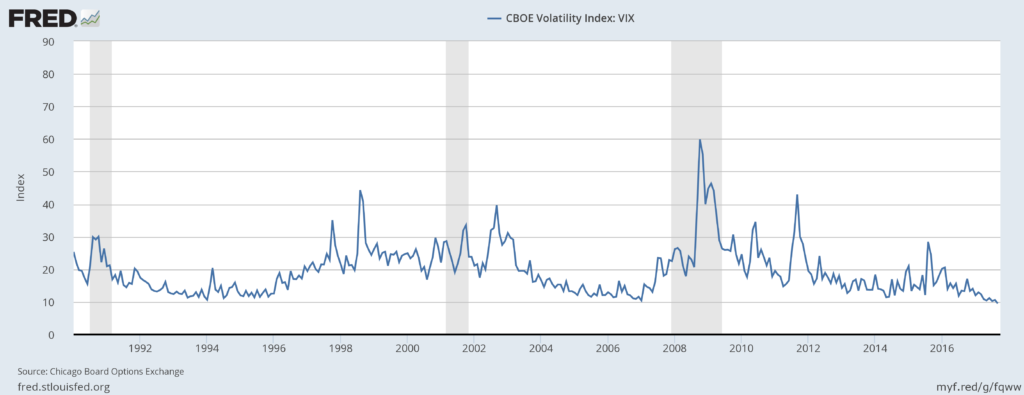

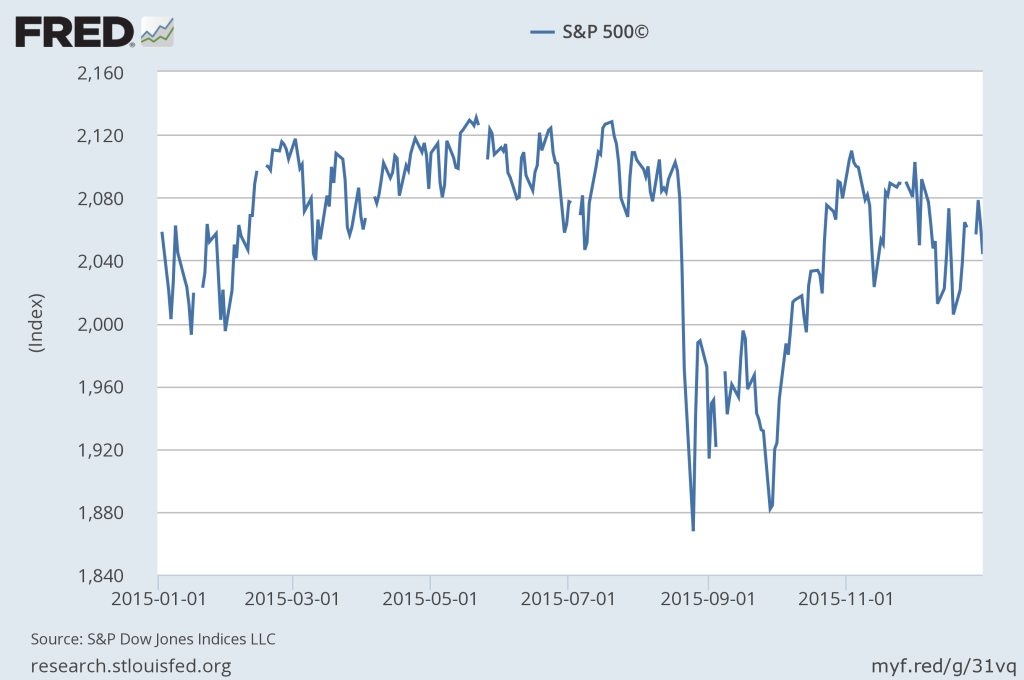

Fundamental investment work has been rewarded this year as market volatility remains at, or near, record lows, as persistently low interest rates at home and abroad have sustained equity market’s reasonable pace to record highs, and as global economies have joined the U.S. in a broad-based recovery. Sure, there have been a few pockets of sector weakness and market volatility. The Chicago Board Options Exchange (CBOE) Market Volatility Index (VIX), one measure of equity market volatility, spiked by 40% during the final week of Q2. But it is important to view these few, short-lived, and far-between periods of volatility within the context of what has been a period of the lowest market volatility in the history of the measure. The few, short-lived periods of volatility have largely been due to transitory issues, and have resulted in investor rotation amongst markets or market sectors rather than broad-based market sell-offs. To fully understand equity volatility at the end of Q2 one must turn attention away from equities to look at what was going on with interest rates and currencies.

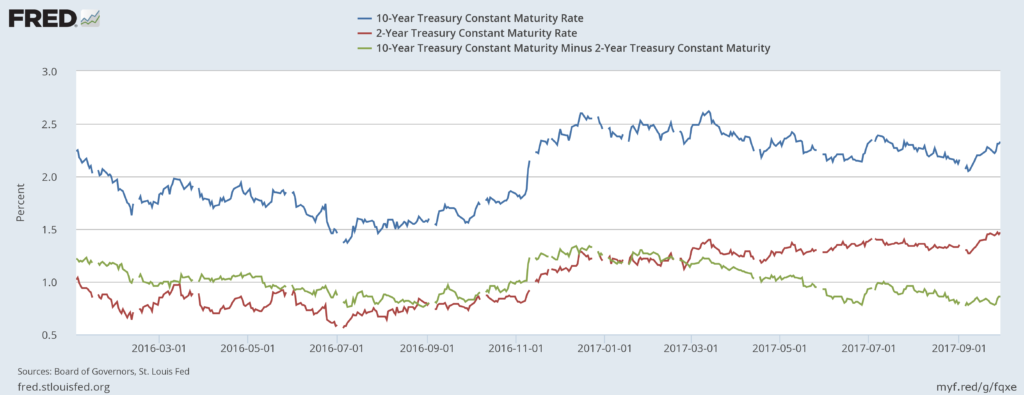

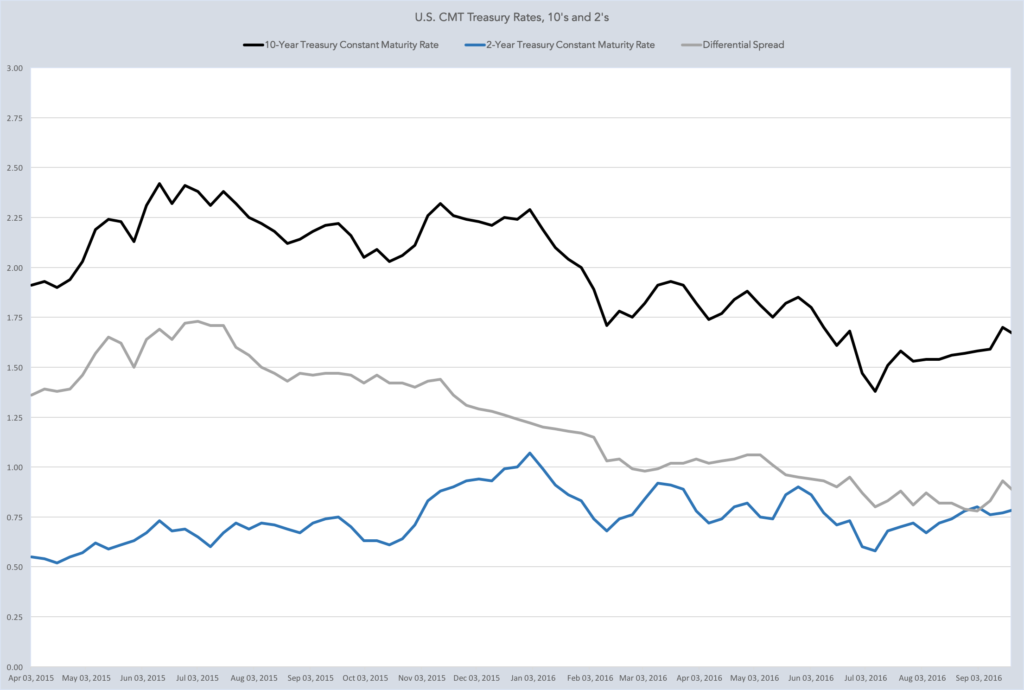

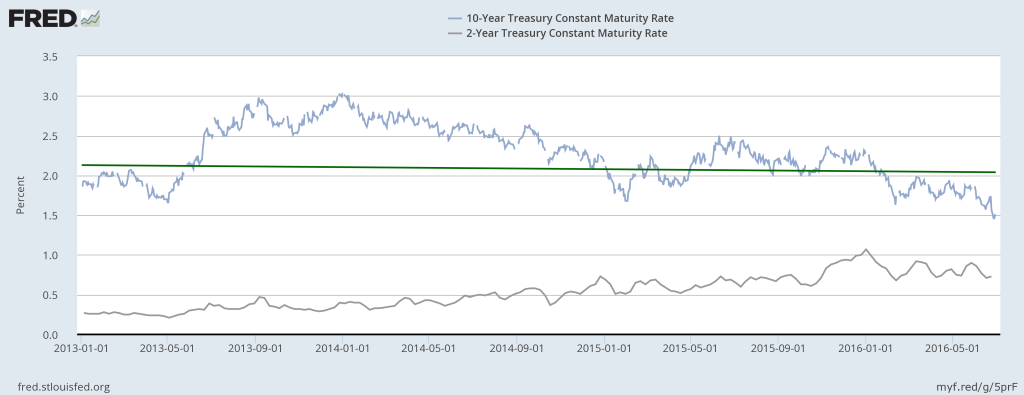

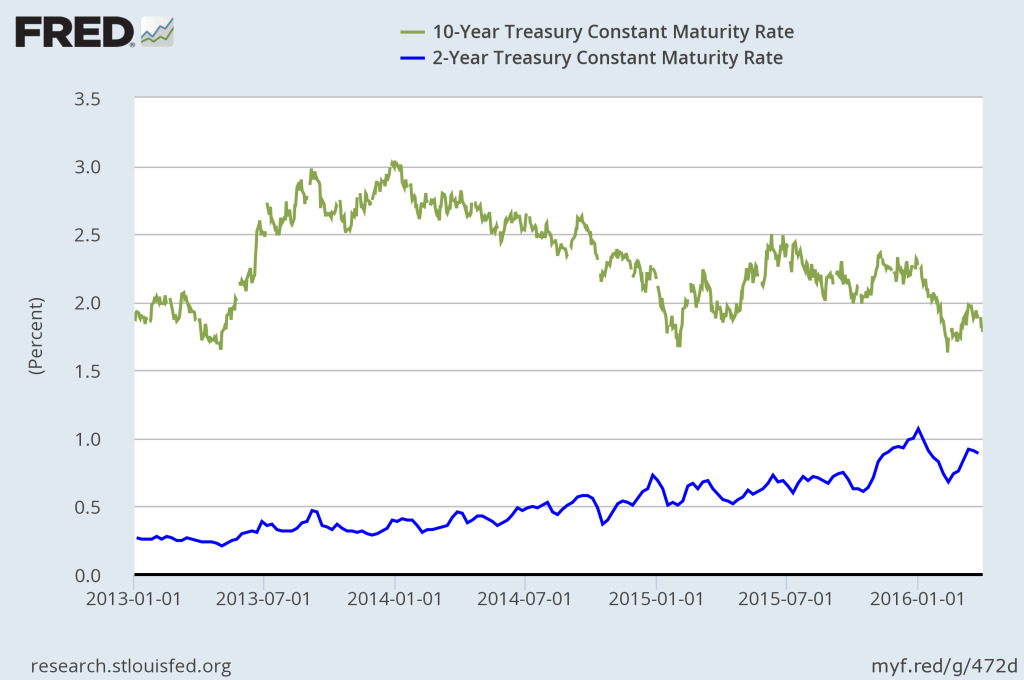

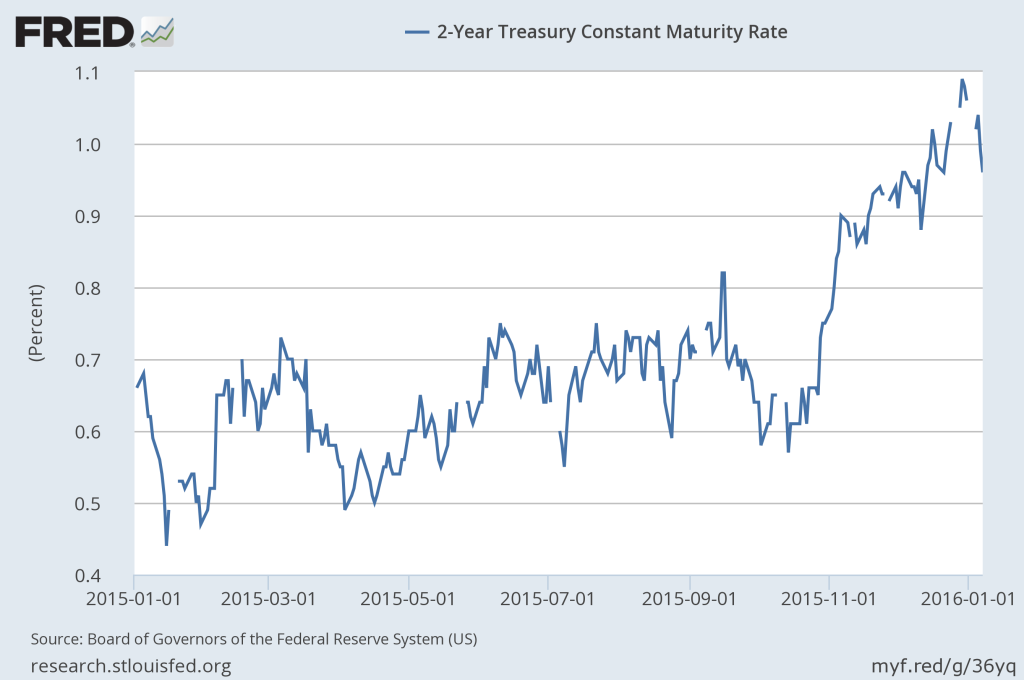

The end of Q2 saw global bond yields rise suddenly following comments from European Central Bank (ECB) president Mario Draghi that the ECB was prepared to reduce its monetary stimulus prior to year-end. Knowingly an oversimplification of the comments, the ECB basically said it is time for interest rates and asset intervention by the central bank in Europe to normalize. Comments not so dissimilar from recent guidance from our own Federal Reserve, so why the impact? Draghi’s comments surprised investors who were thinking that the ECB, much like the U.S. Federal Reserve, would react more slowly to signs of improving economic conditions. No doubt, should the ECB move this year it will be, relatively, at a faster pace than the U.S. Fed has dared move under similar signals. While it is good news that global economic conditions are improving, investors worry that too rapid of a move towards monetary policy normalization could dampen global growth and slow rising corporate earnings before sustainable growth has the opportunity to gain sure footing. The sudden change in investor expectation caused global bond yields (including some interest rates in the U.S.) to shift higher. Although U.S. interest rates had moved a bit lower throughout Q2 pushing domestic bond returns higher, the sudden move towards higher interest rates at the very end of Q2 did take back some of those gains. The impact on global (ex-U.S.) bond funds was more dramatic, with many finishing in the red for Q2. These sudden interest rate movements and the resulting impact on global currencies played a hand in U.S. equity market volatility at the end of Q2.

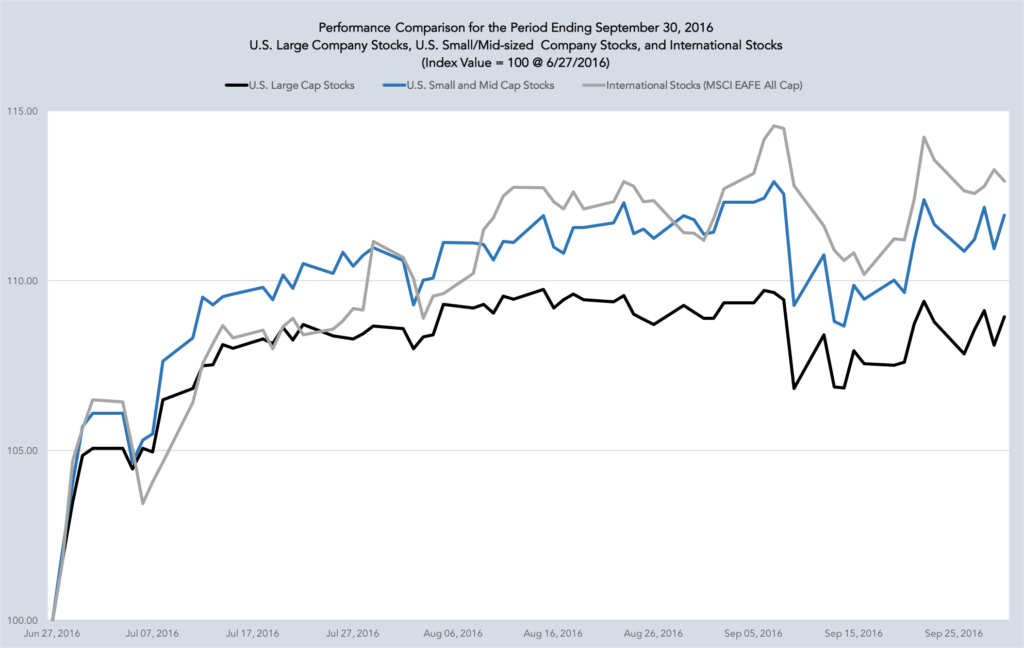

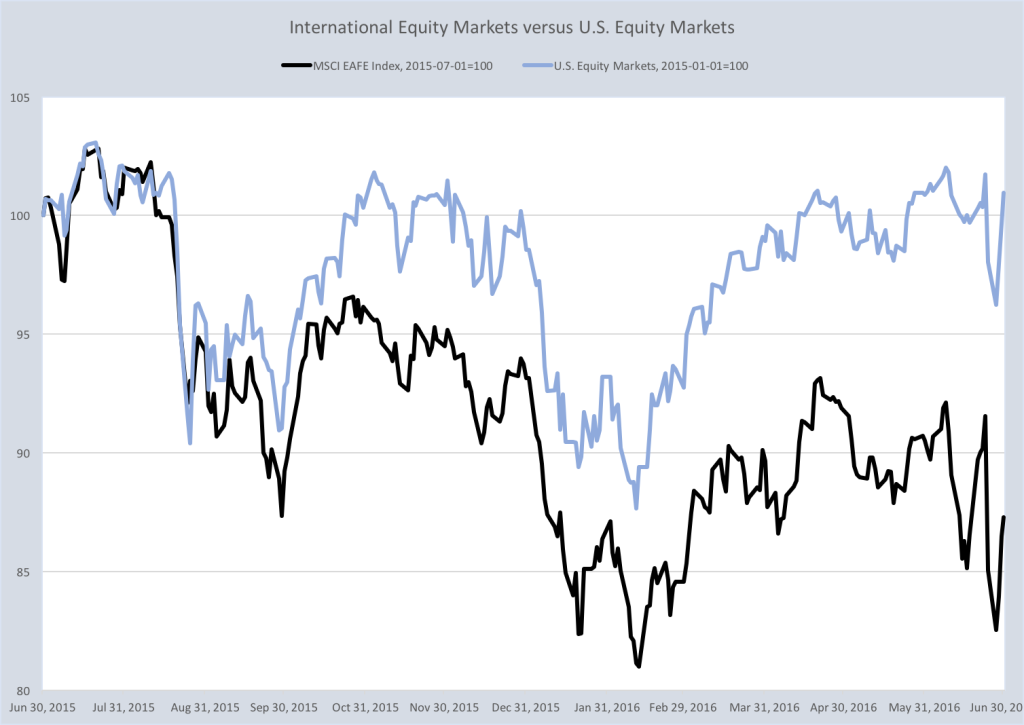

Despite the short-lived volatility, on a total return basis the S&P 500 Index gained 3.09% during Q2 while the Dow Jones Industrial Average (DJIA) gained 3.95%. For the year-to-date through June 30 (YTD), both the DJIA and the S&P 500 Index gained more than 9.0%, at 9.35% and 9.34% respectively. The tech-heavy NASDAQ soared more than 14% during the same period. Even better, international equity markets have out-paced the U.S. market YTD, with the Morgan Stanley All-country World Index (excluding the U.S.) also up by more than 14%. In fact, most stock and bond market indexes have posted solid gains YTD. All but a few dozen funds in the Morningstar 500 (Morningstar’s field of 500 highly-rated, actively managed, diversified mutual funds) finished 2017’s first half in the black. Generally speaking, most industry sectors and portfolio strategies are positive for the first half of 2017. Big companies, little companies, U.S. companies, foreign companies, emerging market companies, growth-oriented strategies, value-oriented strategies, all up solidly thus far on the year. As one would expect, a couple of U.S. sectors and strategies that most benefitted from the post-election “Trump-bump”, excelling in terms of relative performance during 2016 (small company stocks, banks, infrastructure, cyclical/value-oriented strategies), have lagged during 2017 as other sectors and strategies played catch-up. But even with differences in timing of returns, the one-year return numbers for most major sectors and strategies are relatively close by historical standards. Professional investors look to these types of “participation” measures, tests of both the breadth and depth of market performance, to measure market health. With continued wide and deep participation in the current market rally, most consider equity markets fairly or fully valued at this time. I am in the “fairly” camp with most, but I do consider some areas of the market to be “fully” valued and am more conservative when making new investments.

The biggest gains YTD among U.S. diversified funds have been had by growth-oriented funds, in large part thanks to red-hot, mega-cap technology stocks and significant recovery in the biotechnology/genomics space. These sectors were negatively impacted by 2016’s election cycle rhetoric and outcome. With the lack of any resulting policy impact it is no surprise that these 2016 under-performers have overachieved this year. “Technology” itself has been the second best performing industry sector YTD despite itself experiencing a couple of pockets of market volatility during the year, including the final week of Q2. However, the technology sector rebounded quickly and meaningfully in the early days of Q3 and as of this posting sits at or near record index levels. The only better place to be this year has been the healthcare sector. Healthcare, and especially certain sub-sectors within the healthcare space. The healthcare sector has been 2017’s big performer despite domestic policy noise regarding the Affordable Care Act and attempts to repeal, replace, or simply save face. While technology is up about 14% YTD, healthcare is up about 16% YTD with several sub-sectors within healthcare up more than 20% YTD.

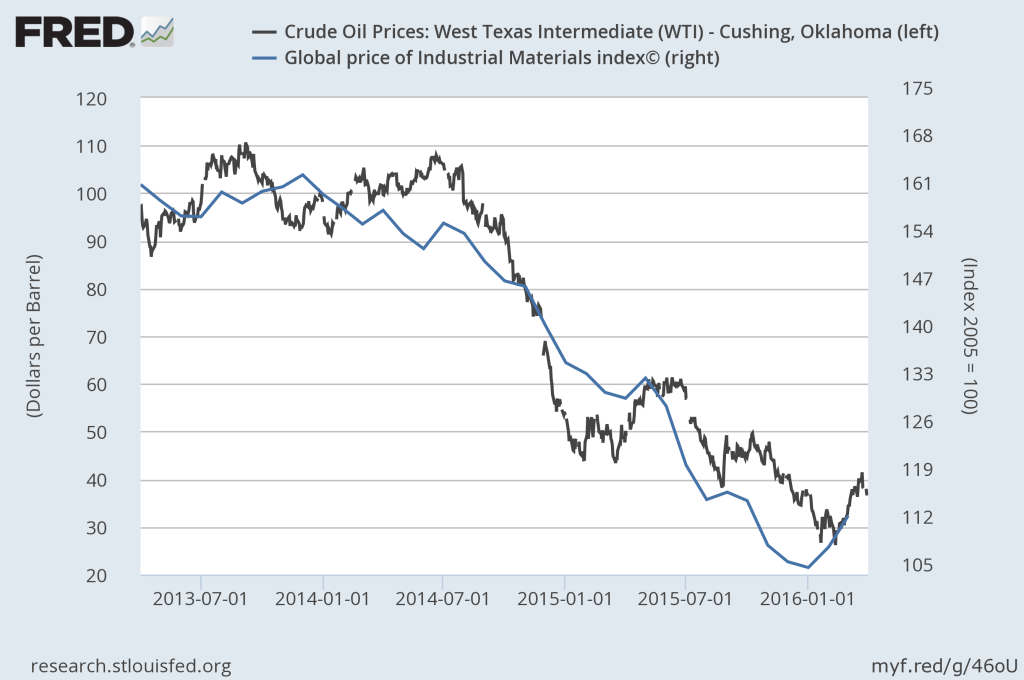

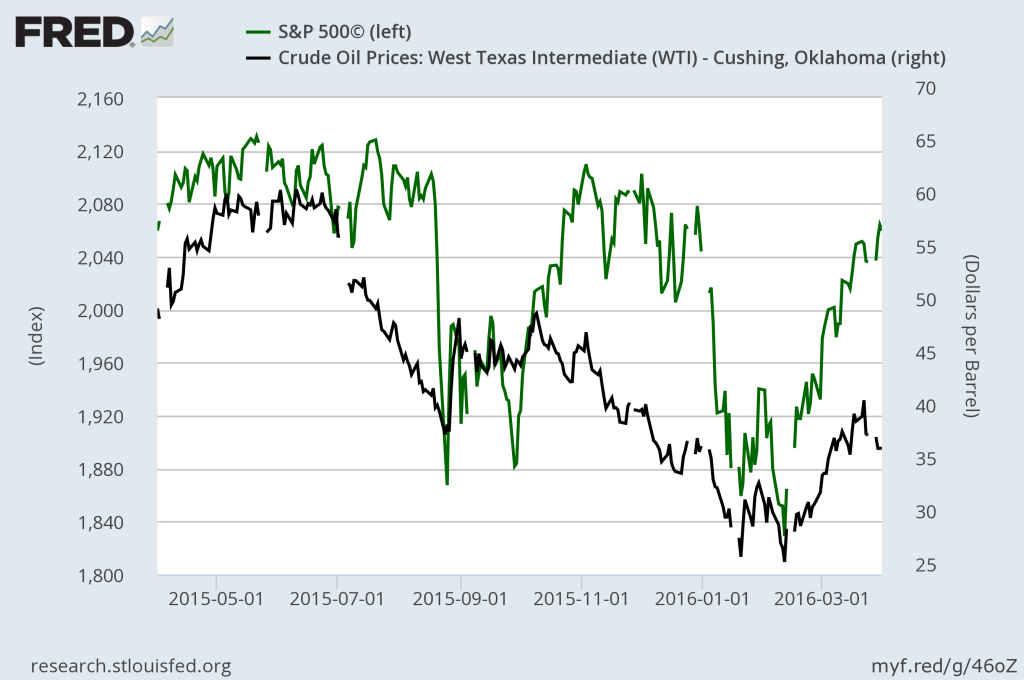

With only one sector serving as an exception, the remaining eight of the eleven S&P 500 industry sectors have all performed within 1% – 2% of the S&P 500 Index’s total return YTD. The lone exception for 2017 is the energy sector. Despite the energy industry growing more diversified within the U.S., the energy sector remains heavily linked to the price of oil. Having started 2017 at about $54 per barrel, crude fell by more than 20% to a 2017 closing low of about $42.50 per barrel, taking down with it share prices of energy sector companies. Energy sector stocks are down, on average, about 13% YTD. Some mega-cap, commonly known names with the greatest oil exposure have been off by about 40% from their 52-week highs experienced during 2016’s crude-oil rebound. However, oil has rebounded somewhat thus far during Q3 as crude is up to about $46-$48 per barrel, and sector stock prices (and expected earnings) are improving. Even with 2017’s lull in crude, this year is shaping up to be far superior for the industry overall compared with the shake-out that resulted from 2016’s sub-$30 bottoming out in the price of oil.

Getting to the specific decisions that influence Lake Jericho client portfolios, let’s briefly cover each of the five levels of our portfolio construction process. And as a brief reminder, no client portfolio will match perfectly typical/target allocation decisions, or sector allocation percentages, as every client experience is unique. These unique factors (such as portfolio start dates, timing of asset transfers, timing of individual contributions or distributions, overall risk profile, etc.) certainly impact exact performance attribution of our strategic and tactical decisions. However, what follows will generally inform you of the nature and direction within your own personal portfolio. Clients should carefully review their individual performance information provided to determine and understand how their particular portfolio is impacted by these decisions and performance versus assigned benchmarks.

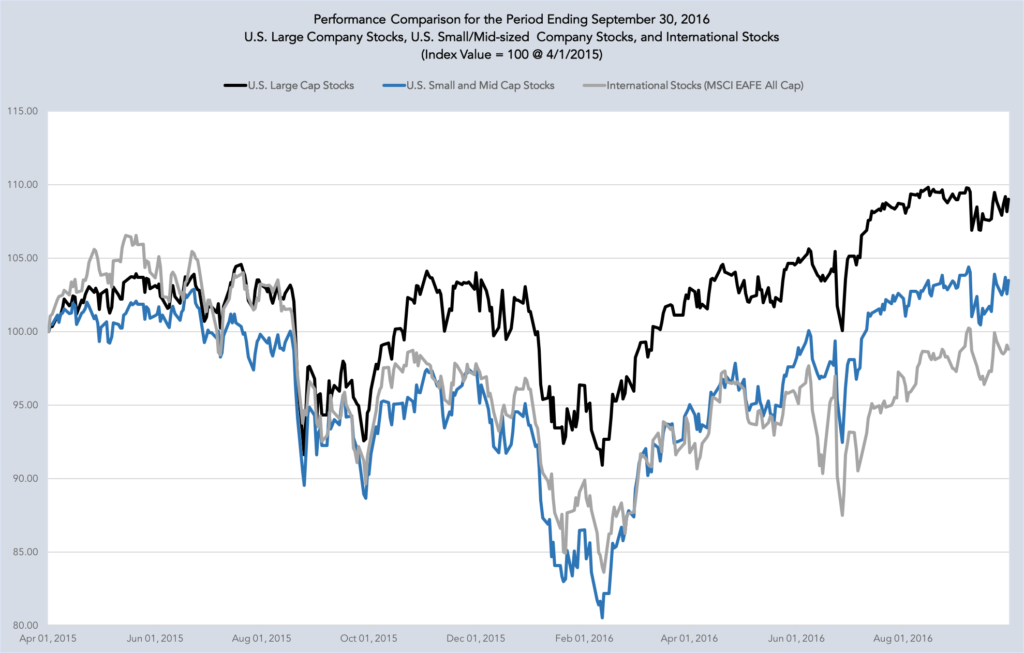

U.S. versus International

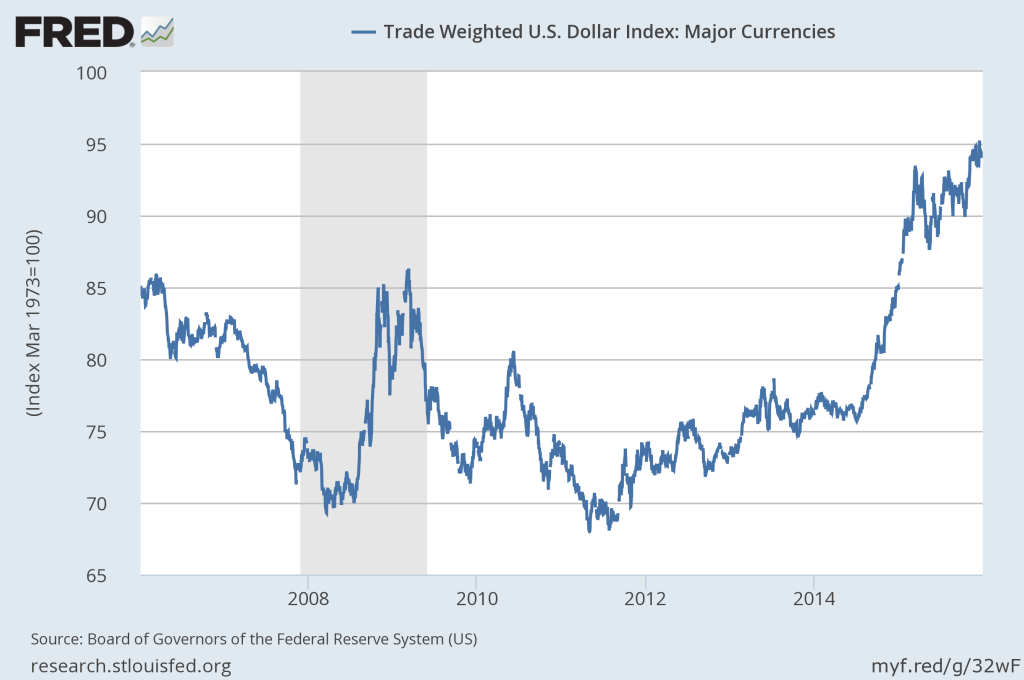

With limited exceptions, the global recovery in economic activity continues and in many regions is gaining steam. Aside from improving growth, international markets are getting a bit of help from from the U.S. in unanticipated ways. At multiple points in the last couple of years I have talked about things that get too expensive and things that get too cheap, and how those pricing distortions stand in the way of economic recovery. The end of 2015 and the opening weeks of 2016 were times when the prices of various assets were distorted and caused all sorts of mayhem in the markets. One of the things that got too expensive during that time period was the U.S. dollar. Due in large part to improving international economic growth, corresponding increases in foreign interest rate expectations, and surprisingly even due to uncertainty surrounding U.S. economic policy, a weakening U.S. dollar is driving a good portion of the outperformance of international equity markets. The U.S. dollar was down 3.45% for Q2, down 6.44% YTD, and with post-Q2 softening now sits near at a year-long low of the Dollar Index (a measure of the U.S. dollar value versus a basket of major world currencies). Supported by a weaker dollar, international equities led the global stock market rally for the second quarter in a row. Emerging-market equities continue to outperform U.S. large-company stocks on a one-year basis. Our overweights to international investments (with small-company, and emerging market overweights imbedded in those investments) served as a meaningful tail-wind for clients. Our method for building international exposure bested aggregate U.S. equity exposure from 1.7% to 3.0% during Q2. Having increased international exposure in client portfolios during 2017 to as much as 30%, this added up to 0.70% of additional return to client performance during Q2 versus an all U.S. equity portfolio.

Stocks versus Bonds

Lake Jericho managed portfolios have been defensively positioned against the threat of rising interest rates since 2015, both in terms of lower overall allocations to bonds and in how we have positioned bond holdings where they exist. We continue to believe that a defensive position is best in the current environment. However, the way in which that defensive position is constructed is the most important part of the decision to be defensively positioned. By design, our approach in the fixed income space is statistically disconnected from standard benchmarks in this particular part of client portfolios (again a gross over-simplification). The purposeful disconnect has been a benefit to client portfolios during the past two years, but did adversely impact client returns during Q2. Versus the Barclays U.S. Aggregate Bond Index, our typical client bond allocation underperformed by about 0.2% during Q2. On a YTD basis, client portfolios are essentially even with that index at +0.02%.

Small Versus Big

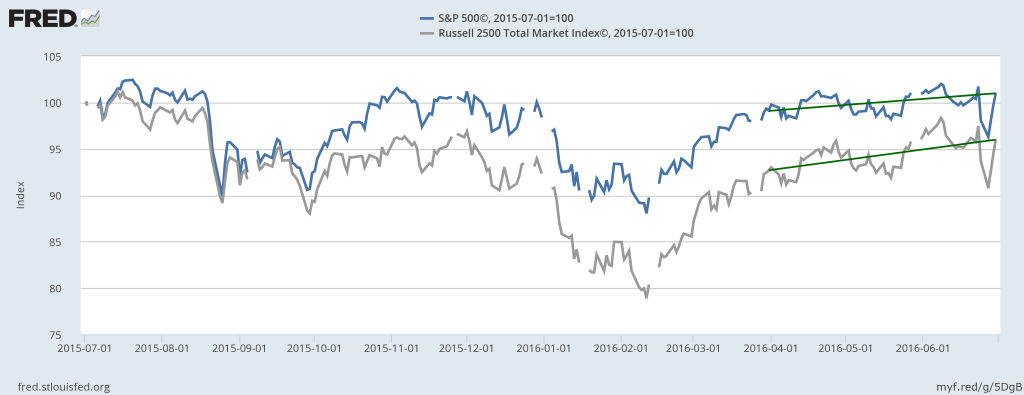

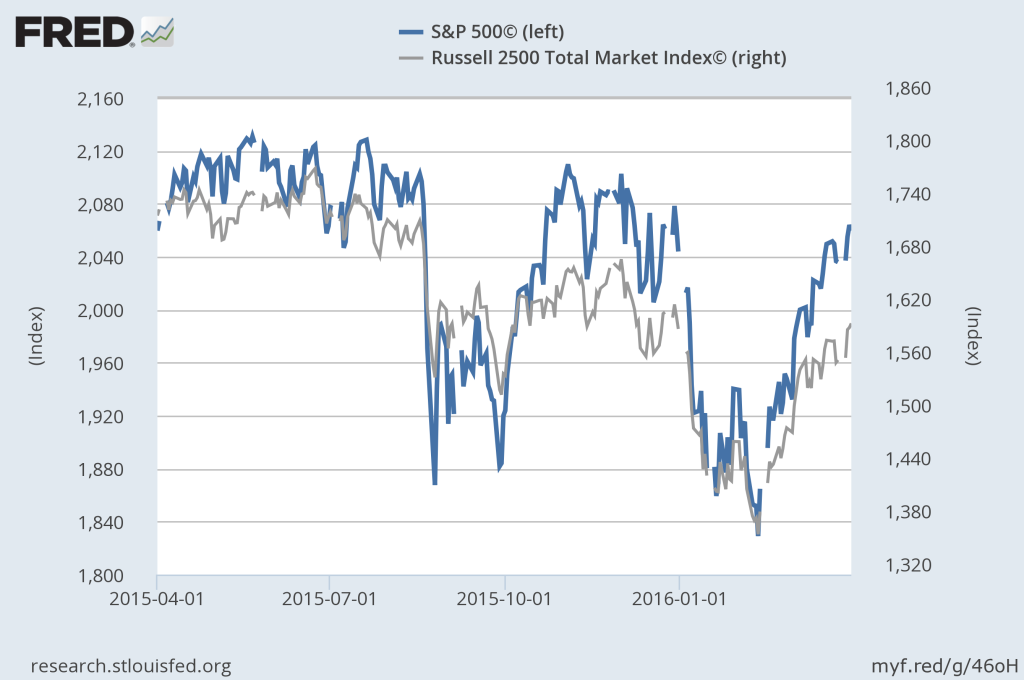

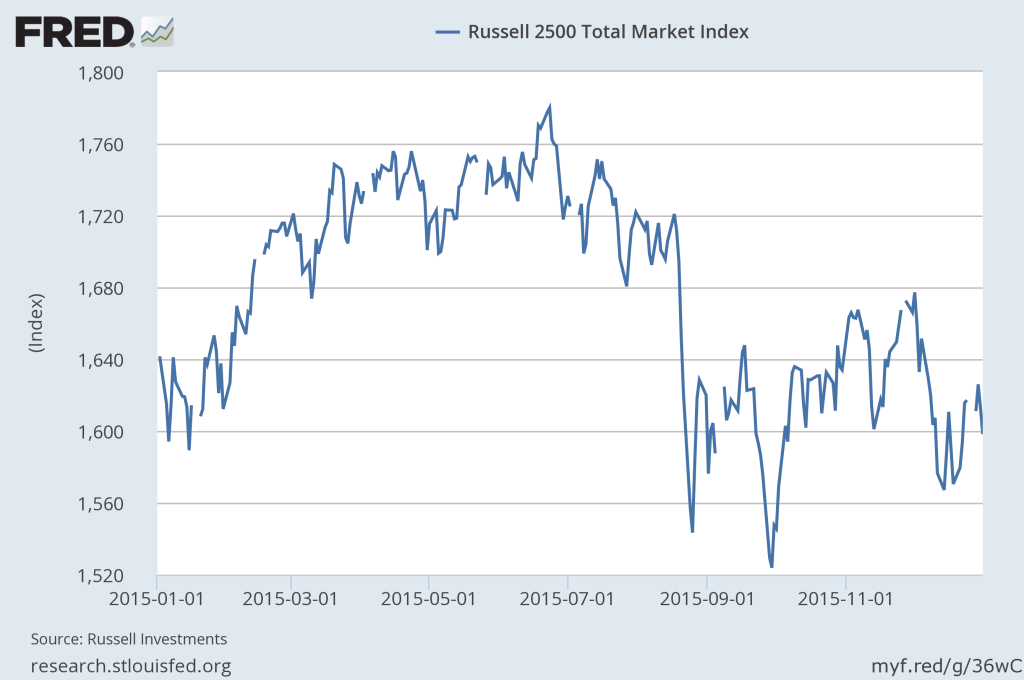

As stated above, the small- and mid-sized company space was one that widely outperformed most other sectors immediately after 2016’s election cycle. That the space has now lagged many other sectors YTD while other sectors played catch-up is no surprise. Nonetheless, one of our fundamental portfolio convictions is that investors should maintain an exposure to, if not an ongoing overweight towards, small- and mid-sized company equity investments at all times. Among the reasons that we hold this belief is the tendency for small- and mid-sized company stocks to demonstrate “clumpy” patterns of return. While on average, over the long-run, the space can provide superior investment returns versus large-company peers, much of the excess performance can occur in short, unexpected time periods. This pattern can then leave much longer time periods of underperformance. We are not in the business of predicting these patterns, much less trading these patterns, rather we are in the business determining and holding as efficient of an exposure to this space as possible over time.

The first half of 2017, as well as the entire year of 2015, is an example of short-run market performance rotating through sectors. 2016, especially post-election 2016, is an example of why you always want to maintain exposure to the space. During 2016, the way we construct small- and mid-sized company exposure bested large-company U.S. equity investments by 8.60%. But none of these time-periods support a position, statistically, that market-timing or risk taking simply for risk’s sake is its own reward. Statistically, there exists in our determination an approximated optimal allocation of small- and mid-sized company exposure to be held in investor accounts that adds value over time without exposing portfolios to unnecessarily high levels of variability. Our answer to best manage this trade-off over time without engaging in unnecessary trade execution is to maintain a fairly constant exposure to the space, and to employ three different strategies simultaneously that best gain exposure to persistent factors of return within the space.

To fairly evaluate our process in the “small versus big” space, we look to the Russell 2500 Index for comparisons. The Russell 2500 Index is a broad measure of blended strategies in both small- and mid-sized U.S. company stocks. During Q2 the Russell 2500 returned 2.13%, 0.96% behind the S&P 500 for the Quarter. Our approach to the space returned 1.60%, 1.49% behind the S&P 500 for the quarter. On a YTD basis, the Russell 2500 has returned 5.97% while our approach has returned 4.87% (3.37% and 4.47% behind the S&P 500). While lagging both the S&P 500 and the Russell 2500 for both Q2 and YTD, our approach to the small- and mid-sized company space has bested both the S&P 500 and the Russell 2500 on a one-year basis. On a one-year basis, our small- and mid-sized company positions returned a weighted average of 19.86% while the Russell 2500 Index has returned 19.84% and the S&P 500 has returned 17.90%. In this regard, our sector allocation decisions have outperformed the S&P 500 by nearly 2.00% during the last year, adding about 0.44% of additional return to the average client portfolio.

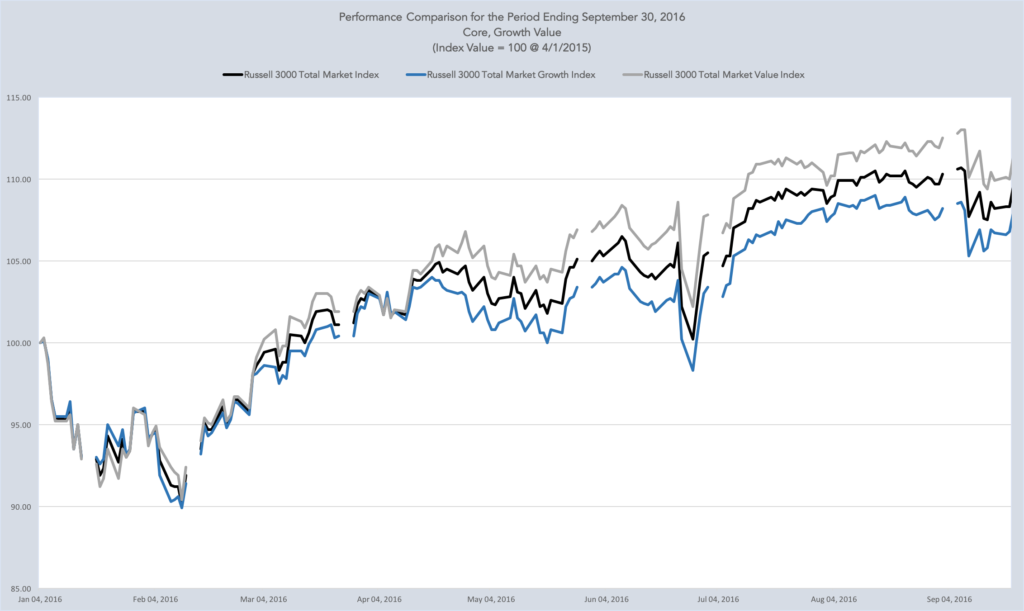

Value versus Growth

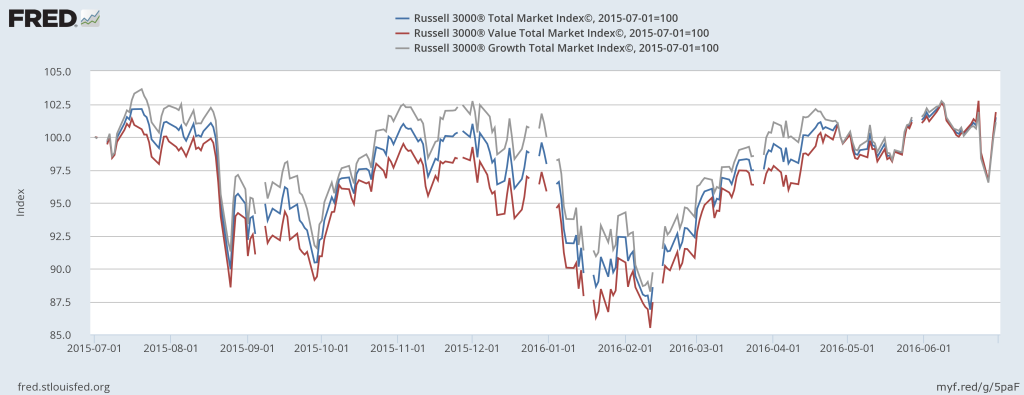

As with small- and mid-sized company exposure, we also believe that investor portfolios should maintain exposure to, if not an ongoing overweight towards, value-oriented investment strategies. The basic premise of value investing is that certain securities are underpriced bargains and are likely to outperform once their “real value” is fully appreciated by investors. It is a bit of common sense, supported by the statistics, that if you remain mindful of not overpaying for your investments then you are more likely to achieve superior returns over the long-run. Value-oriented investing is one method that helps investors achieve this objective. A gross over-simplification of an entire field of financial study, but that is the basic idea.

Last year, U.S. value-oriented equity funds as a group were up 20.79%, according to Morningstar, while U.S. growth-oriented equity funds as a group rose only 3.16%. As a value-biased portfolio manager, Lake Jericho clients certainly benefited from that differential during 2016. But with the overwhelming outperformance of value-biased strategies during 2016, and of certain elements of value-oriented strategies during Q1 2017, that value strategies lagged growth strategies by a wide margin during Q2 is not a great surprise. Again, our focus is on maintaining long-term, strategic positions and not on attempts to time trading patterns.

Sticking with Morningstar measurements, during Q2 2017 U.S. value funds as a group were up a meager 0.24% while U.S. growth funds as a group rose 5.86%. With that type of performance differential during Q2, how could the Lake Jericho managed portfolio compete? Again, I offer a gross oversimplification, but there are two ways in which we managed to offset that performance gap. First, a large part of our value-biased positions increased in value significantly during 2016 (particularly post-election) meaning they begin to exhibit, statistically, more growth-oriented characteristics. Over time, due to portfolio turnover, our positions will return to a more typical value-oriented performance profile. Second, our value bias is constructed both domestically and internationally. During Q2, international markets simply outperformed U.S. markets. Putting both factor exposures together, our target value bias was far more competitive and in the end resulted in only -0.15% of composite performance attribution underperformance for the typical client portfolio versus a 100% U.S. core strategy. For YTD 2016 and on a rolling one-year basis, our target value bias has contributed positive composite performance attribution of 0.09% and 2.20% versus a 100% U.S. core strategy.

Sector Allocation Decisions

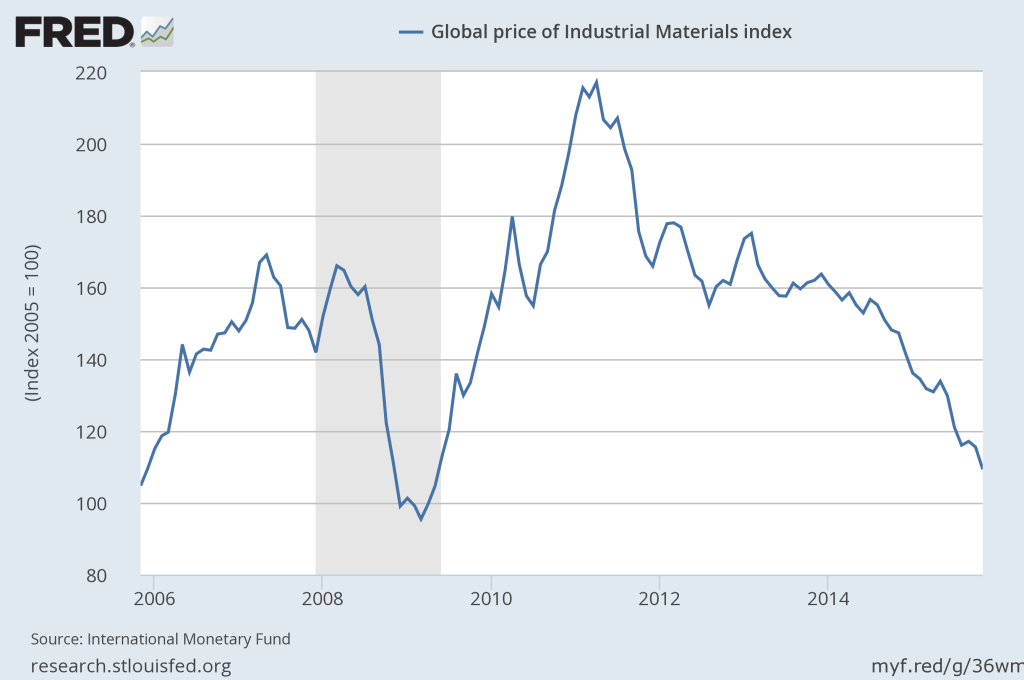

Finally, strategic and tactical sector weighting, the fifth aspect of our portfolio construction process, was an important part of how we added value during Q2. Our process of underweighting U.S. equity market-neutral benchmark allocations in favor of overweighting higher expected growth sectors (currently materials, medical devices and technology, pharmaceuticals, biotech/genomics, and early additions to a regional banks exposure) contributed from 0.38% to 0.72% in excess weighted-average return to client portfolios during Q2. Medical devices (+7.78% over the S&P 500), biotech/genomics (+5.44% over the S&P 500), and pharmaceuticals (+4.02% over the S&P500) all contributed to quarterly performance, while materials (-0.40% behind the S&P 500) trailed slightly. Regional bank exposures trailed the S&P 500 by 2.10% at the end of fairly volatile Q2 for the banking industry. During the early weeks of Q3, our regional bank exposure recovered strongly but continues to bounce between gains and losses. We will continue to hold existing positions and likely add them for other clients as banking sector equity investments position us even more defensively against movements higher in interest rates.

Near-term Outlook

So where does that leave us heading into Q3? We continue to see upside in our long-term global economic growth estimates, with continued higher expectations for both foreign developed markets and emerging markets than for the domestic U.S. market. Client portfolios with limited exception are fully invested and at long-term strategic targets. We foresee little activity for Q3 unless unforeseen events cause meaningful changes in long-term outlook. Other than period reviews and any necessary rebalancing trades, we maintain our “wait and see” approach. I know, due to a few phone calls, that this approach has a few of you worried. If the Washington D.C. claptrap keeps telling us how bad the U.S. economy is doing, where is all of this equity upside coming from? And if equity markets have been in this long, eight-year bull-market move to the upside why am I not getting nervous about valuation levels? Three things make me comfortable with the current level of equity prices. And by comfortable I mean believing that, generally, current equity prices are fair; not cheap but also not too expensive.

First, it is important to pay attention to the data and the data’s time-tested interpretations rather than biased rhetoric attempting to spin data to fit political narratives. Following the global financial crisis, world economies and investment markets were forced to restart from such low levels that even after eight+ years into the recovery there is still room to run. The U.S. economy is strong and growth is accelerating. Global economies are strengthening after nearly a decade of trailing the U.S. and are most likely to lead in the near-term. And one important thing that history teaches us about recoveries is that they don’t tend to die in early acceleration phases, rather they tend to fade after some period of full- to over-employment begins to drive higher than expected inflation. And although growth is happening, deflation in the world’s economies remains a bigger fear than inflation. So yes, we still have some room to run.

Second, along with economic growth, corporate earnings are accelerating. Even better, earnings are accelerating under improving corporate investment in productivity. This is an important positive signal directly linked to corporate economic outlook and indicates that further multiple expansion (how much investors are willing to pay for each dollar of forward looking corporate sales, revenue, earnings, etc., or in layperson terms “rising stock prices”) can be supported. Admittedly, a few sectors were trading at prices that could have only been justified by companies reporting higher earnings during this earnings reporting cycle. Some of these trades got a bit dodgy at Q2-end, and helped contribute to some of the volatility discussed above. However, after some dismal corporate earnings results in early 2016, Q1 2017 saw average earnings growth of nearly 14%. Q2 2017 has seen, thus far, about a 10% improvement in corporate earnings over last. Both of these have been well above consensus expectations and for the 10% average improvement forecast for the full year 2017. Luckily, these earnings reports did help support trades that had gotten ahead of themselves. I doubt that professional investors will get themselves caught up in this dynamic again during 2017. So while I don’t expect the back half of 2017 to enjoy the same market upside as the front half, I don’t see any obvious signs of a reversal that would wipe out the gains we have enjoyed thus far. I would be surprised, and it would have to be the result of some surprise catalyst, if we ended 2017 too terribly far from where we are now.

Third and finally, both current low inflation and the resulting low interest rates remain as a catalyst for growth. As long as inflation remains low as expected, or at least lower than the rate of inflation targeted by central bankers, then moves towards higher interest rates will be slow. Low inflation and slow movements higher in interest rates are both wonderful things to spur economic and corporate investment over time without overheating global economies. I believe that this will be the environment at least through Q2 2018, and should be a good environment for global equities and provide a rather uneventful environment for bond investments.

As always, I am available at any time, any day of the week, to discuss specific portfolio performance questions. I will also be in touch with many of you in the coming weeks to conduct needed reviews of goals and objectives, make any needed changes as a result, and to walk through a few administrative tasks that we might need to tackle. Until then, be well, enjoy the rest of your weekend, and thank you!

A.J. Walker, CFA CFP® CIMA®

Founder, President, and CEO

Lake Jericho, LLC